Best Disability Insurance For Housekeepers And Housecleaners [Why You Need To Protect Your Income]

Updated: April 12, 2024 at 9:40 am

Housekeepers and housecleaners probably don’t think of disability insurance, right?

Housekeepers and housecleaners probably don’t think of disability insurance, right?

You are busy! Moreover, your work can be tough, though. However, you enjoy beautifying your client’s homes or offices. You also particularly enjoy how much your clients appreciate you for the work you do!

What if you could no longer do that job? Have you ever thought about what would happen if you became sick, ill, injured, and disabled? How would bills be paid if you could not work? What would you do? A disability affects the lifestyle you worked so hard for, your family, and your future plans.

Luckily, there is a type of insurance that protects you, your family, and your income. In this article, we discuss disability insurance and the best disability insurance for housekeepers and housecleaners.

Navigation For Easier Reading

Here’s what we will talk about. Feel free to reach out to us directly or our contact us page.

- Why Housekeepers Need Disability Insurance

- The Type Of Disability Insurance Available

- Disability Insurance Underwriting

- The Makings Of A Strong Disability Insurance Policy

- Probably Disability Insurance Costs

- The Best Disability Insurance For Housekeepers

- Now You Know You Can Obtain Disability Insurance!

Let’s start with why you need disability insurance.

Why Housekeepers And Housecleaners Need Disability Insurance

It’s simple, really.

Simply put…

If you are hurt or sick, and can’t work, AND you and your family will struggle to pay the bills (think: your mortgage, the utilities, groceries), you need disability insurance!

Here’s a better way to put it. Your clients are very important. There is also a group of people who are more important. Who can be more important than my customers, you think. They pay my income.

True. They do, but they don’t love you as your family loves you. By far, if you have a family, your spouse and children rely on you more than you think. They love you more than anything. You wouldn’t want anything to happen to them, right?

If you’re disabled, there are tough questions that need answering.

Would you and your family be able to continue your standard of living without your income? If not, what changes would need to be made?

Would your spouse have to work or work more? Would you need to sell your home to make ends meet? Some people have to.

Who could be flexible with the children?

Would you have the money to hire someone to take care of the kids? The tough questions go on and on.

Disability is a destroyer of dreams. Your future and family dreams could be destroyed. They don’t have to, though. With disability insurance, you have peace of mind knowing that you have a plan – and income – in place should the unexpected happen.

Yes, But A Disability Won’t Happen To Me

You think it won’t. However, the probability of having a long-term disability is anywhere between 1 in 3 and 1 in 4 workers. Contrast this to unexpected death, say from a motor vehicle accident, which is 1 in 114. Even dying from cancer has better odds: 1 in 7.

You think it won’t. However, the probability of having a long-term disability is anywhere between 1 in 3 and 1 in 4 workers. Contrast this to unexpected death, say from a motor vehicle accident, which is 1 in 114. Even dying from cancer has better odds: 1 in 7.

But, John, I’m not going to get hurt or be in a wheelchair, you say. Wow! I respond. If you know that, then you should not be a housekeeper or housecleaner. You need to play the lottery or have your own Atlantic City or Vegas show!

In all seriousness, when we think of disability, we think of someone bound in a wheelchair, right? Not true and far from it. According to the Council For Disability Awareness, 90% of disabilities are from illnesses (like cancer) than from accidents. That means an illness or condition, such as cancer or a heart condition, has a higher probability of disabling you than a skiing accident.

Ok, John, but I have workers compensation. I don’t need to worry about money. That’s great, I say. Did you know that 5% of disabling conditions are work-related, leaving the other 95% not covered by workers compensation? That makes sense, since 90% of disabilities are from illnesses.

Again, what is your income plan if you can’t work?

Types Of Disability Insurance Available For Housekeepers

There are really 3 types of disability insurance available for housekeepers and housecleaners. We will discuss alternative insurances later in the article.

The 3 disability insurances include:

- short-term disability insurance

- long-term disability insurance

- accident-only disability insurance

Many people ask us about the difference between short-term disability insurance and long-term disability insurance. Here’s the difference.

Short-term is really designed for a disability of a short time period. Let’s say you break your hand. Well, it’ll be hard to work as a housekeeper with a broken hand, right? So, that is a disability – you can’t do your job as a housekeeper/housecleaner. How long does a broken hand heal? Two to 3 weeks? Once you’ve met the waiting period, you’ll be eligible for benefits and receive some disability benefits.

Long-term insurance becomes the life-saver on those disabilities that last longer than 3 months. Cancer… a catastrophic injury…ALS…Diabetes…you name it. Most families can get by financially when one member has a short-term disability. Sure, it might be tough, but families can get by. It’s a long-term disability that can financially ruin families.

Both insurances generally use the own-occupation definition of disability. (More on that in a minute.)

Finally, there is accident-only disability insurance. Think of this as a “last resort” disability insurance. It will only pay a benefit if you are disabled due to an accident. The better carriers offer coverage for both on and off-the-job injuries. Usually, there are no health questions. Most accident-only disability insurance is affordable. The reason is that most disabilities are not caused by accidents.

In this article, we focus on long-term disability insurance. However, you can always contact us to learn more about short-term disability insurance or accident-only disability insurance.

But, I Really Want Short-Term Disability Insurance

We receive many phone calls from housecleaners and housekeepers wanting short-term disability insurance.

I hate to say this, but short-term disability insurance has to be the biggest waste of money on the planet.

If another agent says you need short-term disability insurance, you should question his or her intention. We feel that short-term disability insurance isn’t worth the money.

Wait? Why do you say that?

Here’s why.

Why Short-Term Disability Insurance Is A Waste Of Money For Housekeepers And Housecleaners

For one thing, short-term disability insurance costs a lot more. I mean A LOT!

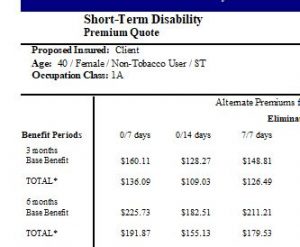

Just look at this real short-term disability insurance quote for a housekeeper. I  assume the median income for a housekeeper of about $25,000.

assume the median income for a housekeeper of about $25,000.

A typical housekeeper can expect to pay anywhere from $110 per month to almost $200 per month, assuming he or she is self-employed. If not, then you pay the higher amount 🙁

Why would you pay all that and not have coverage for the long-term? That brings us to our second point. The coverage is short-lived. If you are still disabled after the benefit period, you are up a creek financially.

What’s the best way to protect yourself in the short-term? If you said “emergency savings”, you are right. Do you see why? Most families could not only “get by”, but also save those premiums. It’s the longer-term disabilities that make it tough for families to carry on.

If you do need short-term coverage, you can always lower the waiting period on the longer-term policy to 30 days. Often, the long-term disability insurance policy is still cheaper and provides longer-term coverage. We discuss this more in a minute.

Disability Insurance Underwriting For Housekeepers And Housecleaners

During the underwriting process, the carrier reviews your application information and background. It then determines your insurability – in other words, will the carrier approve or decline your application.

Underwriting for housekeepers consists of 4 areas:

- your age

- income

- health conditions

- your occupation

Your age and income are straightforward. The older you are, the more expensive the policy will be. The higher your income, the higher the benefit, and the higher the premium. Don’t worry about the actual premium. I’ll discuss that more when we talk about premiums below, and how we are different than other agencies.

In case you were not aware, your income is your W-2 gross salary if you are an employee. So, if your W-2 salary is $30,000, that is the number used for underwriting. Carriers like to look at the last 2 years or 3 years and average out. So, having the last 2 or 3 years of salary on hand is handy for the application process.

Let’s talk about health conditions and your occupation next.

Pre-Existing Health Conditions

Carriers generally exclude pre-existing health conditions from coverage. For example, if you broke your right wrist 5 years ago, your policy excludes coverage on that right wrist. If you had complications of pregnancy, then the carrier excludes any complications of future pregnancies. That’s just how disability insurance works. Remember, the carrier is underwriting your potential disability. So, it will (generally) exclude any previous or current health complications or injuries.

If you have more serious health conditions, the carrier could place a rating on your policy. A rating is an extra premium the carrier charges for an increased disability risk. Moreover, the carrier may limit options such as limited waiting periods or reduced benefit periods.

Having an exclusion or a rating is not a reason to ignore a disability insurance policy. There are nearly endless ways for a disability to occur.

Your Occupation As A Housekeeper Or Housecleaner

Your Occupation As A Housekeeper Or Housecleaner

All the disability insurance carriers classify occupations. In general, the carriers classify occupations from 1 or A to a 5 or 6. An occupation with a class 6 has the lowest disability risk due to occupation and class 1 has the highest. All things being equal, you’ll pay a higher premium if you are a class 1.

Disability insurance carriers usually classify housekeepers and housecleaners as a 1. In some cases, a higher classification may be available.

Back, arm, and other musculoskeletal problems arise from the housekeeper occupation. It is tough work. There is a greater chance of disability compared to other occupations. Moreover, let us not forget the chance of an illness, which discriminates no one.

The Makings Of A Strong Disability Insurance Policy For Housekeepers And Housecleaners

Our goal when designing a disability insurance policy for housekeepers and housecleaners is the combination of value and premium. In our opinion, however, there are several “non-negotiables” that we like to see in a disability insurance policy. These elements strengthen the policy and your benefit in case of your disability.

The first is the own-occupation definition. This means your disability is based on your ability to do your job as a housekeeper or housecleaner. Why is this important? Let’s say you hurt your shoulder badly. Well, it’ll be tough to do your job, wouldn’t it? Because you can’t do your job as a housekeeper, the plan pays a benefit.

If your policy did not have this definition, the carrier could make the case that you can do another job, such as a security guard. If that happened, the carrier doesn’t pay a benefit.

Another “non-negotiable” feature is partial disability benefits. You’ll want this. All this means is that the carriers pay you a partial benefit if you can work, but just not full-time. Many carriers offer this, but they have a stringent definition. We work with carriers that offer an easier definition for housekeepers.

Of course, you’ll want to insure the most income you can. If you are an employee, most carriers will insure 60% of your salary. For example, if you have a gross monthly salary of $3,000, you can cover up to $1,800 (60%). If you are self-employed, carriers insure your net income. More on that in a minute.

Disability Insurance Policy Basics For Housekeepers

There are several definitions and provisions you’ll need to understand about disability insurance to make an informed decision.

Every policy contains an elimination period, or also known as a waiting period. This provision confused many people. It is the length of time that elapses before disability benefits begin when you make a claim. For example, a 90 day elimination period means your benefit period will begin after 90 days of disability. You become eligible for disability benefits on the 91st day. Nearly all carriers pay every month, so you won’t receive your first disability benefit until day 120 of disability.

What does this mean? This means you need to have adequate savings to carry you and your family through this period until benefits begin.

Or, you can opt for a lower waiting period, say 30 days. However, as we stated earlier, short-term disability insurance doesn’t make financial sense.

The benefit period is the amount of time that you’ll receive benefits. Let’s say you have a 5 year benefit period. You hurt your back. You can receive benefits for up to 5 years for that claim on your hurt back.

Optional Disability Insurance Riders

You can add optional riders at an additional cost to your policy to best fit your needs and budget. Some popular rider options for housekeepers and housecleaners include:

Return of Premium Rider: The carrier returns your net premiums back to you. Note that this can be a very expensive option.

Guaranteed Insurability Option Rider: Allows you to obtain the coverage you need now with the option to purchase additional coverage in the future without evidence of good health. You generally can purchase additional coverage every 2 years up to age 55. (You do not need to wait 2 years if you had a life change, defined as a marriage the death of a spouse, divorce or birth or adoption of a child; Instead within 3 months of a life change, you may purchase additional coverage.)

Retroactive Injury Benefit Rider: Pays benefits from the date of disability due to injury if disability occurs within 30 days of the injury and continues through the elimination period. This is relatively inexpensive and may prove useful for housekeepers.

Activities of Daily Living Rider: This rider pays an additional benefit if you can’t perform two or more of the activities of daily living. Additionally, it will pay if you are cognitively impaired.

Residual Disability Rider: This rider will pay a benefit if you return to work in your occupation, and you experience an income loss of 20% or more compared to your pre-disability income. Usually, you will receive a percentage of your lost income. For example, let’s say you return to work and experience a 40% income loss. If your monthly disability benefit is $4,000, you will receive $1,600.

Protect Your Business If You Are Self-Employed

Are you a business owner or self-employed? If so, you have an advantage. You can enroll in a policy that will pay your business expenses upon a disability. The policy is called a business overhead expense policy. Premiums are tax deductible.

If structured properly, benefits are tax-free as well. This type of policy will ensure your business remains solvent during your inability to work from a disability. This is an additional reason why housekeepers and housecleaners need disability insurance. Contrast this policy to a traditional disability insurance which pays a percentage of your net income.

Carriers who offer this type of insurance typically offer a discount on a disability insurance policy. Additionally, we only work with carriers that offer an occupation upgrade as well.

Probable Disability Insurance Costs

Probable Disability Insurance Costs

I am sure you want to know how much all of this will cost. You have to remember, this is important coverage. I know you feel the same way. Otherwise, you would not have looked into disability insurance.

Having said that, you don’t need to spend an arm and a leg.

Remember What Drives The Cost

Disability insurance might cost between $2.00 per day and $4.00 per day, maybe more, maybe less. The actual premium amount depends on underwriting. As we said:

- your age

- occupation

- health

- income insured, and

- preferences towards different options (as we discussed above)

You can’t change your age, and you can’t necessarily change your occupation. You can change your health…to a point. If you have type 2 diabetes, for instance, nearly all carriers will increase your premiums to compensate for the increased disability risk. Remember, we discuss that most disabilities are from disease and illness rather than accidents.

If we state this all a different way:

Disability insurance will generally cost 4 cents and 6 cents for every dollar you make. Think about that!

Do you think that it is expensive? I bet you buy coffee almost every day or your lunch. What is more important? Insuring your income or buying a cup of coffee? There are many ways to afford disability insurance.

We at My Family Life Insurance try to keep our client’s premiums below $100 per month. Nearly all of the time, we accomplish that. You can easily customize a comprehensive policy for less than $100. Honestly, I think we might be the only agency that aims for that. The reason is we know you have other things to spend and save (like your retirement).

Nevertheless, we can structure a plan that protects you and your family, while meeting your needs and budget. We’ve helped many clients this way, and I am sure we can help you, too.

The Best Disability Insurance For Housekeepers and Housecleaners

You are probably wondering who we like to work with. First, we work with many disability insurance carriers. So, we are sure we can find one that meets your needs and budget.

However, there is one carrier that stands out to us. That carrier is Illinois Mutual. An A- rated carrier, Illinois Mutual operates in the middle-income market. More specifically, it offers a niche product designed for professions like housekeepers and housecleaners. They offer a variety of options that customize to your specific situation. Moreover, the premiums are generally very competitive. They even offer simplified underwriting (i.e., no medical exam) in many cases.

Illinois Mutual is not available in every state. No worries, though. If you live in a state where Illinois Mutual is not available, we have other affordable options.

Now You Know Why Housekeepers And Housecleaners Need Disability Insurance!

We hope now you have a solid idea why housekeepers and housecleaners need disability insurance. Confused? Don’t feel that way. We’re here to help educate you and protect your income and future. Don’t know where to start? Use this disability insurance needs analysis worksheet. Follow the instructions; it is rather easy to fill out (we at My Family Life Insurance try to make understanding insurance easy). Next, feel free to reach out to us for our assistance or a quote. Use the form below if you want to.

It is important to note that we only work for you, your family, and your best interests only. Many agents may work for one carrier. That means, one solution. We don’t since we are not beholden to anyone except you, your family, and your best interests. We have helped many housekeepers and housecleaners secure the right disability insurance for their specific situation, giving them and their families peace of mind.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".