Understand Your Dental Insurance!

Updated: April 12, 2024 at 9:39 am

It’s no secret; dental insurance is pretty important to your health. Many reputable healthcare sources state that there is a link to proper dental hygiene and your overall health. However, many people don’t have proper dental insurance. Additionally, many believe it is a waste of money. Part of the problem is that they don’t understand dental insurance. Doing so can not only save you a ton of money, but also help you with managing your dental care. In this article, we will help you understand dental insurance so you can make an informed decision about your insurance and your care. We break down the lexicon into easy-to-understand terms. Think of this article as your “go-to” guide to understanding this important insurance.

It’s no secret; dental insurance is pretty important to your health. Many reputable healthcare sources state that there is a link to proper dental hygiene and your overall health. However, many people don’t have proper dental insurance. Additionally, many believe it is a waste of money. Part of the problem is that they don’t understand dental insurance. Doing so can not only save you a ton of money, but also help you with managing your dental care. In this article, we will help you understand dental insurance so you can make an informed decision about your insurance and your care. We break down the lexicon into easy-to-understand terms. Think of this article as your “go-to” guide to understanding this important insurance.

Dental Insurance Need

When I speak to people, many of them tell me dental insurance is a waste of money. Or, they are needlessly spending hundreds or thousands on services or procedures. They just keep spending, and then one day they say, “Forget it. I’m done paying for something with little benefit!” They cancel their policy and go without for several years. Then, they have major tooth pain, and they don’t know what to do next since they don’t have any dental insurance.

Or, they just self-pay. On the whole, that seems logical, but a serious procedure or service might cost thousands when insurance could pay a majority of it.

It doesn’t have to be this way. You can spend an affordable amount each month and have proper dental care. After reading this article, you won’t feel like you are spending an arm and leg (or a molar and a bicuspid, in this case) on dental insurance. We have helped many people obtain affordable dental insurance.

Fact is, we all need dental care. This means we all need proper dental insurance. After reading this article, you should have a better understanding of dental insurance. You will be able to manage your care better and won’t need to resort to other alternatives, like purchasing a discount dental plan or doing nothing.

The Most Important Step To Understand Dental Insurance

As with anything, there is a foundation of dental insurance that you need to understand.

The first thing you need to understand is that there are really two types of plans: an HMO plan and a PPO plan. An HMO plan usually has a lower premium than that of a PPO plan. However, with an HMO plan, you always need to go to an in-network dentist. You will also need to go to any in-network specialists. If you go out of network with an HMO plan, you’ll be in for a nasty and high bill. Contrast this with a PPO plan, where you can go to any dentist. Additionally, many PPO plans have their own dentist networks.

Next, you want to do is make sure your dentist is in the dental insurance network. You’ll save a lot more money this way. Nowadays, however, there are many dentists who operate out-of-network and accept no insurance. If you like or have a dentist that does not accept any insurance, and many don’t, no worries; we have some options described below.

Honestly, I feel this is the most important step. Selecting an in-network dentist will save you money. I think this is why so many people tend to think dental insurance is a waste of money. It’s not. It can become a waste when you have a dentist that doesn’t accept your insurance. This happens a lot with group dental insurance through your employer. You could live in Illinois and go to a dentist in Illinois. If your employer’s dental plan is based in Arkansas, chances are your dentist in Illinois doesn’t accept a carrier based in Arkansas. Then, your out of pocket spending is high.

You’ll see this theme throughout our article.

Dental Insurance Basics

In this section, we will discuss some basics that will help you understand dental insurance.

The first is the term, premium. This should be easy to understand. The premium is the amount of money you pay each month for dental insurance. Of course, the lower the better! But, sometimes you do have to pay a higher amount for better coverage.

The second term is the annual benefit. Many people mess this up. This is the money the carrier pays on your behalf each year to the dental provider. Think of it as a bucket of money, replenished each year, for your use. Let’s say you have a $1,000 annual benefit (or “bucket”). You have a cleaning that costs $200. The carrier pays this in full, so you have $800 left. Five months later, you complain of a toothache. You have a cavity. That costs $300, but the carrier pays 80% and you pay 20%. In this case, the carrier pays $240 to the provider. The remaining amount is $560 for your benefit.

Most plans have a deductible. You should know what that is. You’ll pay this amount first before the carrier pays its share. Some plans have a one-time deductible, which means you pay this deductible once and that is it. Other plans might have an annual deductible, but applied on basic or major services only. In any case, you have to pay the deductible first.

After that, then there is your coinsurance. The coinsurance is the share of the cost you and the carrier pays. Let’s say the carrier’s coinsurance is 80%. This means the carrier pays 80% of the fee reimbursement to the provider. You’ll pay the remaining 20%.

Other Dental Insurance Areas You Need To Understand

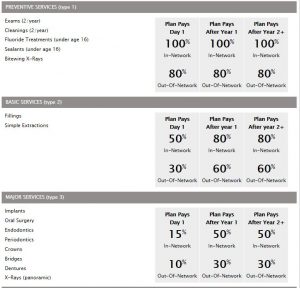

Those should be easy to understand. Let’s get into more detail. Most dental insurance has three areas of coverage: preventative, basic, and major services. Preventative services are simply cleanings, some x-rays, and exams. If you go to an in-network, the carrier usually pays 100% of this. (If not, you have a bad plan and need to change). Basic services comprise of fillings and simple extractions. Finally, major services cover all that big stuff like root canals, periodontal services, bridges, etc.

The coinsurance for these areas a similar across many carriers. Of course, you will want the plan with the highest coinsurance amount, all things being equal. Here is the standard coinsurance for each of the service areas:

Preventative

Carriers usually cover preventative services at 100% if (and a big IF) you go to an in-network dentist. That means the carrier pays 100% of the cost. You walk in. Get your teeth cleaned. The dentist exams your teeth. Maybe an x-ray is taken. The insurance pays 100% for this. Again, if you go to an in-network dentist.

Well, I don’t. What happens then?

If you don’t, the coinsurance might be 80%. You pay 20%. Additionally, the carrier might only reimburse based on the negotiated in-network fee. This means you’ll have a huge out-of-pocket bill, likely. I am getting way ahead of myself, and we will explain this in a minute.

Most of the time, insurance carriers cover preventative services immediately with no waiting period. A waiting period is just how it sounds – the period of time you must wait before you are eligible for services. Carriers put these on to prevent people from using the plan and then canceling quickly.

Basic

Basic services are usually covered at 80% coinsurance. This means you pay 20%. This is for in-network dentist coverage, unless you have a true PPO plan that allows these coinsurance amounts.

Some dental carriers have a 6 month waiting period on basic services. Other carriers have immediate coverage, but you will pay a higher coinsurance amount within that first 6 months.

Additionally, if you go to an out-of-network dentist, your coinsurance could be much higher. For example, some carriers might pay 50% coinsurance, which leaves you on the hook to pay much more.

Don’t worry, we will get into all of this coinsurance with an example soon.

Major

Major services, remember, are services like root canals, bridges, and crowns. The coinsurance here is usually 50%, but some carriers are a bit higher. Carriers shell out big money on major services. Therefore, a majority of carriers have a 12 month waiting period on any major service. There are a few carriers that have immediate coverage for a major service if you can demonstrate you have had prior dental insurance. Additionally, some carriers have immediate benefit, but a lower coinsurance amount within the first year.

If you use an out-of-network dentist, that changes a lot. Your coinsurance will probably be much higher.

This is a good time to show you an actual example of how all of these coinsurances for in-network and out-of-network plans work. We will also discuss costs and pricing.

Example of Services

Here is the coverage from a real dental insurance carrier. I think everything we have discussed up to this point will be clear after reviewing this illustration:

Let’s start with Preventative services. You can see that the plan covers 100% of the fee if you go to an in-network dentist. If you don’t, they will cover 80%. And, you will have to cover the remaining 20%… and probably more. Why is that? We discuss that next.

You can also see, in this plan, you have immediate coverage. If you need basic or major services in the first year, you will pay more than if you wait a year.

Let’s go back to the in-network versus out-of-network dentists. If you use an in-network dental insurance plan, like this one, you will keep your out-of-pocket costs low. This is important. So, let’s discuss this in more detail, and I’ll provide some examples of how this all works.

In-Network Dental Costs

You’ll see why we promote going to an in-network dentist whenever possible. It all has to do with your out-of-pocket costs. Let us use the above illustration as the starting point. We will also introduce a new term called UCR fee.

You go to Dr. Jones. He is in your network. Let’s say you have had the dental insurance plan for 2 years. You have a cleaning completed. Dr. Jones typically charges $300 for a cleaning, x-ray, and office visit. However, Dr. Jones is in your dental insurance network. The carrier requires him to charge you $200, which is the negotiated insurance fee. The plan pays 100% since this is a preventative service visit. You pay nothing.

During the visit, he noticed you have a cavity in your back molar. Not a problem, he says. He can take care of it and it shouldn’t take more than 30 minutes. You reschedule a time next week to get the cavity filled. This is a basic service. Since you have had the plan for 2 years, the carrier pays 80% and you will pay 20%. Dr. Jones usually charges $225 for this type of cavity removal and fill, but the carrier requires him to charge $150. The carrier’s share is $120 and you pay $30.

Are you with me so far? Sounds easy, right? It is easy when you go to an in-network dentist. Carriers require in-network dentists to charge their contracted rate. They can’t charge anymore. They could charge less, but who will do that? Hopefully, you can see the benefit of going to an in-network dentist.

When you go to an out of network dentist, the costs change…and drastically.

Out-Of-Network Dental Costs

Let’s use the same example, but Dr. Jones is out of network. You have a cleaning completed. Dr. Jones charges $300 for the cleaning, x-ray, and office visit. He is happy to file the insurance on your behalf. The carrier’s fee for cleaning, x-ray, and office visit is $200. The carrier pays Dr. Jones $160, which is $200 X 80%. (Remember, he is out of network.) What do you think you will pay? If you said $40, that is not right.

You’ll likely pay $140!

Why $140? It’s because out-of-network dentists are not required to accept the negotiated contract rate in full. They can balance bill.

What the heck does this mean, you ask? I don’t understand why my dental insurance allows this?

It means they can accept the payment from the insurance carrier and then bill you the difference. In this example, their “retail” rate is $300. Dr. Jones receives $160. So, he will then bill you the $140. They allow it because Dr. Jones, in this example, is not a contracted provider.

I firmly believe this is why many people feel dental insurance is a waste of money. They are using in-network insurance plans with out-of-network dentists. You need to know your situation, and if your dentist is in the network.

Sounds good, John, you say. But, I like my dentist and she does not accept any insurance. What do I do?

Let’s discuss that next.

What Happens When Your Dentist Does Not Accept Any Insurance?

This is a common situation. Many dentists don’t accept insurance. They are business owners, and they don’t want their revenue tied to an insurance carrier. What do you do? Well, there are (what I like to call) true PPO plans that will process with any dental provider.

The key difference with these plans is that they pay off the usual, reasonable, and customary fee (UCR fee) for the service in your area and NOT the negotiated insurance rate. We will give an example that makes this clear.

First, though, let’s discuss what the UCR fee is in more detail. The carrier keeps track of the “retail” costs of what dentists charge in your area. If you want to know what this is, don’t ask us. Carriers keep this in-house for obvious reasons. If you want to know, I recommend your calling a carrier and asking them what their UCR fee is. Or, you could go to www.fairhealthconsumer.org to find out an estimate.

Let’s move on. Carriers pay a percentile of the fee range providers charge in your area. The average percentile is usually around 75%. Some carriers pay a lower percentile and some higher. Of course, you want an insurance carrier that pays a higher amount, like 80% or 90%.

It’s also important to note that many true PPO plans have one coinsurance amount. In other words, they will pay your dentist provider 100% of the UCR fee for preventative services, 80% for basic, or 50% for major.

Let’s show this in an example.

Example Of UCR Fee

Again, the UCR fee really comes into play when you have a true PPO plan that pays for any dentist. Let’s use our example again. Dr. Jones is out of network. You have a cleaning completed. Dr. Jones charges $300 for the cleaning, x-ray, and office visit. He is happy to file the insurance on your behalf. The carrier pays at the 80th percentile for the UCR fee. In this case, it is $280. The provider pays the $280 to Dr. Jones. Technically, Dr. Jones could still balance bill you $20.

What if Dr. Jones charged $280? Well, he would receive $280 and you have no remaining bill.

And, what if Dr. Jones charged $250? Then the carrier pays Dr. Jones $250, not $280.

Hopefully, this makes sense.

Because true PPO plans pay a higher amount to the dental provider, they usually charge a higher premium compared to an in-network plan. Maybe not that much more – like $10 more per month – but it is more.

Which is right for you? You have to go back to your dentist and determine your out-of-pocket cost exposure. Personally, I go to a dentist who does not accept insurance. I do so because he and his practice have been instrumental in keeping my teeth well. I never had bad teeth, but their knowledge and care are unmatched. My family and I use a true PPO plan to cover myself and my family. I do have out of pocket expenses, but the coverage is much better than if I went with an in-network plan that only reimbursed the negotiated insurance rate. I feel I would have paid much more in out of pocket expenses.

Summary To Understanding Your Dental Insurance

We talked alot about dental insurance; there is a lot to understand. Here is the abridged version to understanding dental insurance and saving you money:

(1) determine if your dentist is in any dental networks or not

(2) depending on the answer to #1, start reviewing plans

(3) understand your deductible, coinsurance amounts for each type of service as well as your annual benefit on the dental insurance

(4) understand any waiting period

(5) start using your insurance!

Conclusion

Hopefully, after reading this article, you understand your dental insurance a lot better. Or, this article will help guide you into making the right decisions with your dental insurance. Would you like to speak to us and have us help you? We would be more than happy to discuss your situation and see how we can help. Feel free to contact us or use the form below. As with all of our clients, we only work in your best interests.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".