Using The Right Income For Disability Insurance

Updated: April 12, 2024 at 9:39 am

Make no mistake about how important disability insurance is. We have written about the importance of disability insurance ad nauseam. Recall that disability insurance pays YOU a benefit in case you can’t work due to a disabling condition. That disability benefit from the insurance carrier is based on the income you have made.

Make no mistake about how important disability insurance is. We have written about the importance of disability insurance ad nauseam. Recall that disability insurance pays YOU a benefit in case you can’t work due to a disabling condition. That disability benefit from the insurance carrier is based on the income you have made.

Insuring your income (that’s essentially what disability insurance is) sounds easy. However, discrepancies happen. For example, sometimes, a disability insurance carrier will exclude your income from coverage. It’s true!

What if you use the wrong income amount on the application? Or, what happens if your income increases? Additionally, what if you have several sources of income from different occupations? What do you do?

In this article, we discuss using the right income for disability insurance. This is an extremely important topic as your income is the basis for your monthly disability amount.

First – A Disability Insurance Refresher

As we mentioned, disability insurance pays you a monetary benefit if you are disabled and can’t work. Do you need disability insurance? Read the statement below.

“If you and your family will struggle to pay the bills and other household expenses (like your mortgage) upon your disability, you probably need disability insurance.”

If that’s a true statement, then read on.

You use your disability benefit to help pay for your:

(1) mortgage

(2) utilities

(3) food

(4) anything you need to live on

Disability insurance underwriting includes the process of insuring your income. If disabled, you’ll receive a percentage of your income, depending on the plan you have and your circumstances. It’s easy to see how important your income is. Depending on other factors, the carrier’s underwriting team may want to see a copy of your recent tax filing or request additional information to verify the income amount on your application.

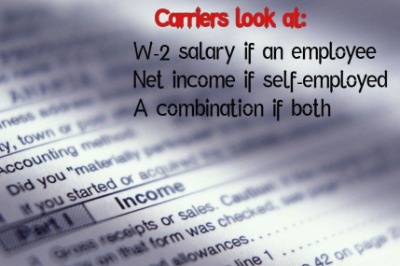

There are really 3 situations of income for disability insurance:

(1) you are a W-2 employee with a gross salary

(2) you are a self-employed / business owner / independent contractor

(3) you have a combination of the above

Carriers are insuring the money you’ve made BEFORE you pay taxes on them. Many people give me their after-tax (net) amounts, but the carriers aren’t insuring that type of income.

Let’s dive into these 3 situations and discuss them further.

W-2 Employee Income For Disability Insurance

A W-2 employee situation is straightforward. Your disability benefit is based on your gross salary. You probably (and should) know this amount. If you don’t, it’s typically your wages in box 1 of your W-2.

In this section, we are going to use income and salary interchangeably.

Many disability insurance carriers will want to know your last three years of W-2 income/salary on the application.

They will want to know your:

- year-to-date income,

- last year’s income, and

- income from 2 years ago

The underwriters are looking for the stability of income. A typical growth or increase in income is OK. Actually, carriers expect that.

However, the variability of income /salary among years will lead the underwriting team to likely offer a conservative monthly benefit.

Let’s say your W-2 income is $95,000, but it was $50,000 last year and $85,000 the year before. The carrier will not only want to know why, but also may adjust your monthly disability benefit. However, good reasons include having a baby, taking care of a loved one, switching jobs (while in the same occupation), etc.

Traditionally, carriers will insure anywhere from 60% to 70% of your W-2 income. Remember that your W-2 income is your gross income. Or, known as your gross salary.

What does this mean? Let’s say your annual W-2 income is $50,000. If the carrier insures 60% of this, you will have $30,000 insured. On a monthly basis, this is $2,500/month ($30,000 / 12).

Why only 60%? If you make a claim and receive a benefit, that benefit is not taxable to you. That’s a big chunk of the difference. Moreover, receiving a benefit of less than 100% of your salary does incentivize you to go back to work, right?

How Self-Employment Income Affects Disability Insurance Coverage

Many people receive some type of self-employment income nowadays. Disability insurance carriers treat self-employment income a bit differently. You should know what is self-employment income. The money you receive from being a 1099 independent contractor or a business owner is self-employment income.

In these cases, the carriers really need to know your net income. That is right. Your net income. What is net income? Well, for starters, it is not your gross salary. Then, what is net income?

Your net income is simply your gross income – in other words, your revenues – less your business expenses. Your net income is what’s left. This is the income number disability insurance carriers want. It is your income BEFORE taxes.

Why do disability insurance carriers want net income? As we said, this is the amount that is before taxes.

Too often, when I ask a business owner his or her net income, I am given gross income. Disability insurance carriers don’t want gross income – or gross revenues. You’ll find your net income on line 31 of the profit and loss statement in your tax return. (Your schedule C) Look below:

If you have other self-employment, such as a K-1 , read below.

Other Types Of Self-Employment Income

Things can get a little tricky when it comes to other types of self-employment income. What do I mean by that?

Let’s say you are a partner in a business. This is still self-employment income. Your income in this case is on your K-1 statement. This is usually equivalent to your net income as well.

What if you pay yourself a salary (as an employee) in addition to the money you receive from the partnership? Well, since both the W-2 salary and the K-1 income are before taxes (usually), you combine these two values together.

Contact us if you have questions on which income you need to use. We can help.

This brings us to our 3rd scenario.

What If You Have Both W-2 Salary And Self-Employment Income?

As I mentioned earlier, more and more people have different sources of income nowadays. Remember, your gross income/salary from a W-2 employee perspective is similar to your net income for self-employment income. Both incomes are taxed at the federal and state level. Both are incomes that you then use to pay for your mortgage, your electric bill, your groceries, etc.

If you pay yourself a salary, for instance (as some business owners do), the salary amount is added to any net income amount generated by your business or to any K-1 partnership income.

However, not all income is counted. These scenarios where income is not counted (and, therefore, not covered) depend on what occupations you work and how many hours per week you work in those occupations. Let’s talk about some common income situations many people face nowadays and how they affect coverage.

Income And Employment Situations That Affect Your Disability Insurance Coverage

There are countless income and employment scenarios that affect your disability insurance coverage.

Insuring your income depends on:

- the occupation you have, and

- how many hours per week you are working in said occupation

We will go over many scenarios.

If you have any questions, or have a unique situation we haven’t described, as always contact us. We are happy to chat.

What About Other Employment?

It is common nowadays for people to work 2 or more jobs. Which income do you use? Well, the answer is whether or not you work in the same occupation. You see, disability insurance carriers insure not only your income, but also your occupation.

If you work in the same occupation, then usually there’s no issue. For example, let’s say you are a massage therapist. You work 25 hours each week as a W-2 employee, earning $40,000. You then work about 15 hours each as a self-employed massage therapist earning $20,000 net income.

Since you are in the same occupation, carriers look at your total income and your total work hours. So, in this case, you are a massage therapist working 40 hours per week and making $60,000.

Differing Occupations Can Be An Issue

If you work two or more occupations that are different from one another, the carrier selects your riskier occupation (from a disability standpoint) along with the corresponding income you make, assuming you meet the carrier’s minimum hours/week worked requirement. Most carriers require 30 hours or more for coverage. An example will make this clear.

Let’s say you are a massage therapist again. You work 30 hours per week as a W-2 employee, making $40,000.

But, let’s say you work as a bank teller part-time 15 hours per week. It is a W-2 job, and you make $15,000. What is your income for disability income purposes? Well, it’s not $55,000. Actually, your insurable income is $40,000 as a massage therapist. The carrier does not consider your bank teller position because you only work 15 hours per week. If the carrier accepts a minimum of a 10 hour week for coverage, then your income as a bank teller is also covered.

Income From Many Occupations

We often receive phone calls from people with numerous occupations. They might earn $50,000 annually, but it’s derived from 3 or more jobs. They may work 10 hours as a barber, 15 hours as a roofer, and another 10 as a barista at Starbucks.

As you can tell, these are three different occupations: a barber, a roofer, and a retail employee (barista). In this case, since the person is working fewer than 30 hours in any occupation, disability insurance is usually not available. That is the hard truth. People who work in numerous occupations are usually ineligible for individual disability insurance. In this case, the person does not meet the required hours week per worked, which is usually 30 minimum for one occupation. (We do work with one carrier that has a 10-hour minimum.)

You need to review the carriers and see what their requirements are.

As we said before, generally speaking, a person needs to work a minimum of 30 hours in an occupation. For example, if the person worked 32 hours per week in the roofing position, he or she would be eligible for disability insurance. The corresponding roofing income is then insurable. The other occupations do not apply.

This situation happens more often than not nowadays, and we have other options to help. Contact us if you are in this position.

Passive Income And Disability Insurance

More and more people are growing their income passively. What does this mean? All this means is that you are not providing labor to generate your income. Maybe you are receiving interest, royalty, or commission from a prior transaction or sale. If you are not materially involved in the production of this income, the income is passive.

Carriers exclude passive income. Why? The income generates whether you are disabled or not. Many carriers have a 10% rule when it comes to passive income. In other words, if passive income accounts for 10% or more of your total income, disability insurance carriers will make an adjustment to your available benefits. Or, depending on the level of passive income, they may not offer disability insurance at all.

If you think you can hide any passive income, think again. Upon application or upon disability claim, the carrier can request copies of your tax returns to confirm sources of income. They can do this as they are potentially insuring you and paying a claim. They have this right.

The internet provides many passive income opportunities. In some cases, these situations aren’t really passive income. If you are an internet marketer, for instance, that is an occupation. However, if you work from home and dabble in arbitrage retail strategies, with no official company or legal status, likely a carrier will challenge your occupation and income. In my opinion, this is a gray area. Even so, if you don’t meet the carrier’s minimum work requirement (usually 30 hours/week), many of these internet side-hustles are eligible for disability insurance anyway.

What If Your Income Increases?

We all want increasing income. How can you effectively protect the income increase with disability insurance?

Well, at the time of application, you must select a “guaranteed purchase option”. This option allows you to purchase more disability insurance without any health evidence when your income increases. Carriers usually specify the timeframe or window when you can purchase more disability insurance. You must provide financial evidence, however, which is commonly supported with your tax return, a W-2, or a pay stub. Keep in mind, though, that this income increase generally corresponds to your insurable occupation.

Let’s say again you are a roofer making $50,000. You have disability insurance as a roofer with a guaranteed purchase option. You dabble in internet arbitrage and suddenly made $75,000 alone from one of these arbitrage strategies. Can you insure the $75,000? Likely not through the guaranteed purchase option unless you are working more than 30 hours in internet arbitrage and have the backup to prove it.

Please note that not all states allow guaranteed purchase options and some carriers have limitations.

Final Thoughts About Using The Right Income For Disability Insurance

We hope this article informed you of the importance of selecting the right income for disability insurance. It’s important that you have the right income amount for disability income purposes. For most people, your income will either be your W-2 employment income or your net income from self-employment. People who work in the same occupation, but have both W-2 and net income simply add both together.

If you have multiple occupations and income streams, disability insurance carriers will have a hard time determining your insurable income. You may even be uninsurable simply from working in numerous occupations.

Regardless of your situation, we can likely help or point you in the right direction! (That is always good, right?) Contact us or use the form below. We would be happy to discuss with you your situation and see how we can help. As with anything we do with our clients, we always have your best interest. This means if we can’t provide the right solution to meet YOUR needs, we will recommend the one that will.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".

4 thoughts on “Using The Right Income For Disability Insurance”

Comments are closed.

I’m a blackjack dealer in Baltimore City, I make an avg if 45,000 to 50,000 a yr, so my hands are important to me, so that being said what is the monthly payment for Disability Insurance if my hands becomes a problem in the future, and how much I would receive in insurance benefits from your company?

Hi Steve – I will send you an email with more information. It’s on its way.

John

Hello,

My partner is a talented goldsmith and is the main breadwinner for our home.

We’ve always talked about insuring his hands as it would be devastating financially should he loose the ability to work.

Can you give us any details regarding the insurance that we might be need.

Thanks so much,

~CAZSRV

Thanks for reaching out to us. As discussed in the article, a comprehensive disability insurance policy is his best option. It will cover his hands as well as any other injury or sickness that prevents him from working.

Feel free to reach out to us. I am happy to discuss this.

John with My Family Life Insurance