How To Choose The Right Medicare Insurance Plan

Updated: April 12, 2024 at 9:40 am

I had a Medicare beneficiary once say to me, “John, this is all a maze. It is so confusing. No wonder why people don’t know what they have or make mistakes.” He was referring to the Medicare insurance selection process. If you don’t know what our practice is about, we really focus on educating our clients so they can understand how the options selected. The same holds true for selecting your Medicare plan. If you choose the right Medicare insurance plan, I guarantee you will save a TON of money over your lifetime. How do you do this? We discuss that here. In this article, we discuss how to choose the right Medicare insurance plan.

I had a Medicare beneficiary once say to me, “John, this is all a maze. It is so confusing. No wonder why people don’t know what they have or make mistakes.” He was referring to the Medicare insurance selection process. If you don’t know what our practice is about, we really focus on educating our clients so they can understand how the options selected. The same holds true for selecting your Medicare plan. If you choose the right Medicare insurance plan, I guarantee you will save a TON of money over your lifetime. How do you do this? We discuss that here. In this article, we discuss how to choose the right Medicare insurance plan.

What Is The “Right” Medicare Insurance Plan??

As we always say, the “right” plan is the one that meets your health care needs and your budget. While we don’t have concrete numbers, our gut tells us many beneficiaries either overpay or underpay for their care.

Most don’t even know what they have, which is kind of like driving across the country without a map.

Most don’t even know what they have, which is kind of like driving across the country without a map.

Nearly all the time, how much a beneficiary pay is within his or her control. If you pay a late-enrollment penalty, that is your fault. You controlled that. If you go to a doctor outside your network. That is, unfortunately, your fault, too. These expenses all add up and save you money if you had the right plan to meet your needs.

Next, we talk about choosing the right Medicare insurance plan.

How To Pick The Right Medicare Insurance Plan

I assume you already know about parts A & B. If you don’t, see our article about here. Once you are enrolled in both A & B, you have 3 options. You can:

- stay enrolled in A & B and select a part D plan

- enroll in a part C plan integrated with a part D plan

- remain enrolled in A&B, select a Medicare Supplement plan, and a part D plan

We don’t recommend the first option at all – to simply remain in A & B. The reason is that your Medicare out-of-pocket costs are unlimited if you just have parts A & B (also known as Original Medicare). A part C plan or a Medicare Supplement plan will limit your out-of-pocket costs.

Here is a quick and simple example. You have only Medicare parts A & B for your hospital and doctor insurance. You get into a severe accident. The hospital bill is $100,000. Medicare will pick up 80%, or $80,000. You are responsible for the remainder, in this case $20,000. If you had a Medicare Advantage plan, your out-of-pocket exposure is limited to $6,700. If you had a Medicare Supplement plan, your exposure could be $0 depending on the plan.

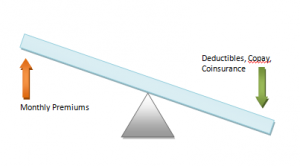

The decision which way to go depends on how many additional premiums you want to pay versus any out-of-pocket costs. It is like a see-saw (see below):

The lower premiums you pay, the higher your out-of-pocket costs. Conversely, if you pay higher premiums, your out-of-pocket costs are usually lower.

Medicare Advantage or Medicare Supplement?

You also want to decide if you want to see any doctor or hospital (a PPO type) or remain in a network (HMO type). Medicare Supplement plans and some Medicare Advantage plans are PPO – you can go to any doctor that accepts Medicare. Because of this freedom, premiums on these plans are usually higher compared to Medicare Advantage plans. As you probably guessed, Medicare Advantage plans are typically an HMO type plan. You need to select a PCP and make sure your doctors and services are within the network. If not, you face out of network charges and your insurance will not pay.

Most Medicare Advantage plans incorporate a part D prescription drug plan. If you buy a Medicare Supplement plan, you will need to pay for a separate part D prescription drug plan.

Medicare Advantage plans and Medicare Supplement plans sometimes offer additional benefits such as dental, hearing, exercise reimbursements, over-the-counter discounts as well as other types of benefits.

That is really what the decision boils down to: do you want to have peace-of-mind and have (depending on the plan) your out-of-pocket costs nearly or all covered? Or, are you willing to pay out of pocket costs for a lower premium?

A secondary decision lies in the network: do you want the freedom to go anywhere that accepts original Medicare? If so, you will generally pay more. Or, do you not mind having your healthcare needs within a network? If so, you will generally pay less monthly premiums.

The Questions To Ask Yourself

In order to facilitate a decision, you need to ask yourself several questions. The below is not a comprehensive list. Do you:

- comfortably have the money saved in case I need to pay significant out-of-pocket costs? We say “comfortably” because if you need to stop eating to pay for a hospital bill, then you don’t have the money. If you do have the money, a Medicare Advantage plan could work. If you don’t, then a Medicare Supplement plan might work or a hospital indemnity plan.

- like a network or do you want freedom? Medicare Advantage plans usually are HMO, network health care. Medicare Supplement plans allow you the freedom to go anywhere that accepts Medicare A & B.

- want your health care needs rolled into one? Or, I don’t mind having three separate cards? Medicare Advantage plans take the services of parts A & B, adds additional services, and include part D (usually). There is one card you need to present. With a Medicare Supplement, you will need to carry three: Your Medicare card, your supplement card, and your part D card.

- want a referral to see specialists? HMO-type Medicare Advantage plans require a referral to see a specialist. Medicare Supplement plans usually do not.

- know if the drugs you take are on the formulary? Whether it is a Medicare Advantage plan or a separate part D prescription drug plan, you need to check to see if your drugs are covered, and if your pharmacy is a preferred pharmacy. You will pay more for non-covered drugs and standard network pharmacies.

- need coverage in case of emergency while traveling out of the area? Do you want coverage if you travel internationally?

And, Don’t Forget These…

Do you…

- visit the doctor frequently? While we can’t predict our future, if you are healthy, a Medicare Advantage plan might save you money versus a Medicare Supplement plan on the premiums alone.

- have a chronic or long-term illness or condition? Conversely, if you have some chronic conditions, then a Medicare Supplement plan might work better in your situation.

- know last year’s OOP costs on your health care. Are you happy with that? You should always know how much you spent on your health care. Carriers usually have online portals where you can review this information.

- take many prescription drugs? If you don’t, a basic and inexpensive part D prescription drug plan could work.

- know if you are subject to the donut hole? If you are, are there available plans that may help you financially? You need to check it out.

- like any value-added benefits such as dental services or fitness reimbursements? If you do, then a plan which offers robust benefits might be more valuable in your situation.

There are many more questions. You need to provide a self-assessment of your needs, current health situation, your doctor, your own costs and budget among other things.

The answers above will help you determine if you need a Medicare Advantage plan or a Medicare Supplement plan.

Now You Know How To Select The Right Medicare Insurance Plan

Choosing the right Medicare insurance plan doesn’t have to be confusing. All it takes is a little bit of an effort to understand your health care needs, what you want, and your budget. It also requires you to understand that there will be out of pocket costs should you enroll in a Medicare Advantage plan.

If you have any questions at all, we are here to help. We know many people trip themselves up with Medicare plans. They pick the wrong plan or don’t know it altogether. We can help you, as we have helped the many Medicare beneficiaries choose the right Medicare insurance plan for their health care needs and budget. Feel free to contact us or use the form below to get in touch.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".