Many life insurance companies offer life insurance riders for policyholders. Life insurance riders allow policyholders to customize their policy to their needs and wants. Like a knot, they attach to your base life insurance policy.

Of course, the more you customize, the more your policy costs. Carriers charge an additional cost for some of these riders.

What?

Yes, many riders come with an extra cost. Sometimes, the cost is worth it. Other times, it is not.

Continue reading The Best Life Insurance Riders And Ones You Don’t Need

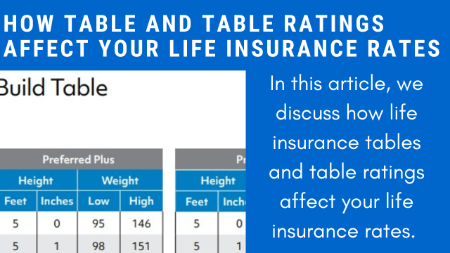

We aren’t talking about kitchen tables. In your search for affordable life insurance, you may have heard of the terms “life insurance tables” or “table rating”.

We aren’t talking about kitchen tables. In your search for affordable life insurance, you may have heard of the terms “life insurance tables” or “table rating”.

Recently, we spoke to a woman who was looking for burial insurance for her husband. She was looking for life insurance to cover his burial and funeral expenses. This is a common reason for burial insurance. She explained to us that he had a health condition, which is no big deal. We all have health conditions. And, burial insurance fits nicely for people with health conditions. However, the health condition he has is

Recently, we spoke to a woman who was looking for burial insurance for her husband. She was looking for life insurance to cover his burial and funeral expenses. This is a common reason for burial insurance. She explained to us that he had a health condition, which is no big deal. We all have health conditions. And, burial insurance fits nicely for people with health conditions. However, the health condition he has is