How Residual Disability Benefits Provide Financial Security | What is a Residual Disability and Why the Residual Disability Benefits Rider is so Important

Updated: November 10, 2024 at 8:14 am

Understanding the nuances between different types of disability coverage is crucial for policyholders in the realm of disability insurance. One important concept that often comes into play is a residual disability or partial disability. In this article, we aim to explain what residual disability is, how it differs from total disability, and why residual disability benefits are an extremely important component of any disability insurance policy.

Understanding the nuances between different types of disability coverage is crucial for policyholders in the realm of disability insurance. One important concept that often comes into play is a residual disability or partial disability. In this article, we aim to explain what residual disability is, how it differs from total disability, and why residual disability benefits are an extremely important component of any disability insurance policy.

- What is a Residual Disability?

- Example of Residual Disability and Residual Disability Benefits

- The Importance of the Residual Disability Benefits Rider

- The Difference Between a Residual Disability and a Total Disability

- Residual Disability vs. Partial Disability

- Average Cost of Residual Disability Benefits Rider

- Final Thoughts About Residual Disability and The Residual Disability Benefits Rider

Let’s discuss what is a residual disability.

Defining Residual Disability

When most people think of a disability, they think of a person in a wheelchair and unable to completely work. However, this type of disability doesn’t happen as often as you might think.

A residual disability is a condition (a medical condition or injury) where an insured individual can still work, but at a reduced capacity or earning potential compared to their pre-disability state. In other words, the individual can still work, but the disability limits him or her to working only part-time. The disability allows the person to perform some, but not all, of the duties of his or her occupation. (While outside the scope of this article, you want to make sure your disability income insurance policy contains own occupation coverage.)

John, does this sound like a partial disability? Am I right?

Good question. Yes; however, disability insurance companies can define partial and residual disabilities differently. If you don’t understand or read your policy, you could be in for a big surprise if you make a partial disability claim. I will discuss the situation later in the article.

Residual Disability Definition

Here is an example residual disability definition:

A degree of disability due to sickness or injury which:

- starts while this rider (more on this next) is in force;

- requires a physician’s care

- results in the insured’s loss of at least 20 percent of their prior monthly income (i.e., before the disability);

- for the first two years after the elimination period, keeps the insured from doing one or more, but not all, of the substantial, material, and occupational duties of their own occupation; and

- after benefits have been paid for two years, keeps the insured from doing one or more, but not all, of the substantial and material duties of any gainful occupation.

If the insured is totally disabled, he or she is not residually disabled.

(Note: the own-occupation rider, if selected, can change this definition.)

Residual Disability Benefits Rider Definition

If you are faced with a residual disability, then you are eligible for residual disability benefits, provided that you have this important provision included in your policy. (Note: I maintain that residual disability benefits, or as I call them, enhanced partial disability benefits, should be part of most disability insurance policies.)

Many companies offer residual disability benefits through a rider. A rider enhances your policy. Purchasing disability insurance riders is like buying a new car. You can get all the bells and whistles you want, but when it comes right down to it, you want that car to get you from point A to point B. The same is true for your disability insurance policy. However, residual disability benefits, as you will see, are an important component of income protection. Don’t overlook this important protection (we provide examples later).

Example Definition

Here is an example definition.

The Residual Disability Benefit Rider will pay a monthly benefit if the insured is residually disabled and the elimination period has been satisfied by any continuous period of total and/or residual disability.

Benefits will continue while the insured is residually disabled or to the end of the residual benefit period, whichever is first. For the first six months of residual disability, we will pay the greater of the residual disability monthly benefit or any partial disability monthly benefit, but not both. We calculate residual disability monthly benefits as follows:

[(prior monthly income – current monthly income) / prior monthly income] x base policy monthly benefit

We consider a loss of prior monthly income greater than 80% as a 100% loss.

Companies pay residual disability benefits at the start of a disability (after the waiting period or elimination period) or returning to work from a total disability.

Let’s unpack this with a detailed example of a residual disability and corresponding residual disability benefits.

Examples of Residual Disability and Residual Disability Benefits

The best way to understand residual disability and how residual disability benefits work is through an example. This is an extreme example, but it will show you how this all works.

The best way to understand residual disability and how residual disability benefits work is through an example. This is an extreme example, but it will show you how this all works.

Let’s say Joe is 40 years old and works as an auto mechanic. He developed sudden pain and stiffness in his right wrist and hand. Thinking it is work-related, he doesn’t think anything about it. But, the pain continues, and he goes to his doctor. His doctor refers him to a rheumatologist. The rheumatologist tests and diagnoses him with rheumatoid arthritis (RA).

Joe’s doctor recommends that Joe reduce his work for now. He develops a treatment plan which includes infusion treatment for the RA.

Because of the pain and tiredness, Joe can only work 2 or 3 days per week instead of 5. As you can see, this is a loss of income. The RA is a disability. Even though Joe can still work, he is not earning 100% of his income because of his disability.

Thankfully, Joe has a disability insurance plan that includes residual disability benefits.

The residual disability benefits pays out after completing the elimination period (waiting period) and a 20% loss of earnings versus pre-disability earnings.

Joe’s monthly benefit, if he were totally disabled, is $4,000.

Let’s say his pre-disability income was $7,000 per month.

Because of his RA, he now earns $3,500 per month. That is a loss of income of 50% ($7,000 – $3,500) / ($7,000)

He would receive $2,000 (50% X $4,000).

So, he currently earns $3,500, and the residual rider pays $2,000 for $5,500 total.

Wait, John, he was earning $7,000 and now receives $5,500?

Right. You pay no income taxes on the residual disability benefit.

More Examples of How Residual Disability Benefits Function

What happens if his RA progresses as a total disability?

Then Joe receives the $4,000 monthly benefit.

Here are more examples illustrating how residual disability benefits work in practice.

Sarah, a graphic designer, earns $5,000 a month before a car accident that leaves her with a severe hand injury. After the accident, she can only work part-time, earning $2,500 a month – a 50% reduction in income.

Sarah’s disability insurance policy includes residual benefits and stipulates a total disability benefit of $3,000 per month. She might receive an additional $1,500 monthly (50% X $3,000) to supplement her part-time earnings. This helps bridge the gap caused by her partial disability.

In another scenario, an office worker named John has a total disability insurance contract that pays $4,000 monthly. After a health issue, he returns to work on a part-time basis, but now only earns 70% of his previous salary, amounting to $2,800. John faces a 30% income loss. According to his policy’s residual disability provisions, his disability insurance company pays an additional $1,200 per month (30% X $4,000).

The Importance of Residual Disability Benefits Rider

Now you can see how important the residual disability benefits rider is. Without it, these individuals and their families would not receive the extra money to support their needs.

This brings us to the importance of having your policy contain residual disability benefits. As I mentioned before, I consider residual disability benefits as one of the important components of every disability insurance policy. Residual disability benefits play a vital role in disability insurance policies for several reasons:

- Financial Support During Transition: These benefits provide crucial financial stability and support for individuals who can work, but cannot earn at their pre-disability income level due to ongoing impairments.

- Encourages Return to Work: By offering partial benefits, residual disability coverage encourages policyholders to return to work when possible, rather than relying solely on full disability benefits.

- Flexibility: Most companies calculate residual disability benefits on the percentage of income loss, allowing for a more flexible and tailored approach to compensation.

- Addresses Real-World Scenarios: Many disabilities do not result in a complete inability to work, and residual disability coverage addresses this reality.

The Difference Between Residual Disability vs. Total Disability

In our example with Joe, we discussed both residual and total disability. To better understand residual disability, it’s helpful to contrast it with total disability:

- Total Disability: This refers to a situation where an individual cannot perform any work (full-time or full capacity) related to their occupation. For total disability benefits, the policyholder must demonstrate that they cannot perform all significant duties of their job.

- Residual Disability: In contrast, residual disability applies to individuals who can still work (part-time), but may be restricted due to their disability, leading to a decrease in their ability to earn money.

The key difference lies in the extent of the disability and its impact on the individual’s ability to work. While total disability is often an “all or nothing” situation, residual disability recognizes partial impairments and their effect on earning capacity.

Key Differences Between Residual Disability and Partial Disability

Let’s recap what we have discussed so far.

A residual disability is any type of disability that allows a policyholder to still work, but not full-time. A residual disability can be anything…a mental disorder, hand injury, or illness like COVID. It can transition to a total disability.

Many disability insurance companies have a loss of income definition to determine residual disability benefits. The loss is usually 20% or more expressed as: ((pre-disability earning – current earnings) / pre-disability earnings). Many companies use an average of your last 12 months of income before the disability to determine your “pre-disability earnings.”

John, this sounds like a partial disability.

Yes, it is. On the surface, a residual disability is a partial disability. Many people use residual disability and partial disability interchangeably.

John, the agent I am working with says my policy contains a partial disability benefit provision, so I don’t need to pay extra for this residual disability benefit rider!

Unfortunately, your agent may have made a mistake. While many long-term disability insurance policies contain partial disability coverage, many of them have limitations.

Common Partial Disability Definition

A common partial disability provision in a disability insurance contract may look something like this:

If the insured is partially disabled and has resumed part-time employment immediately following a period where they received total disability monthly benefits, this benefit will be paid. Benefits will continue until the insured is no longer partially disabled or to the end of the maximum benefit period, whichever is first, but no longer than six months. The partial disability monthly benefit is 50 percent of the base policy monthly benefit.

Additionally, the measurement factor can be:

- loss of time

- loss of duties

- loss of earnings (not usually in partial disability provisions)

Here is an example of partial disability benefits:

- starts while this policy is in force;

- requires a physician’s care unless your physician certifies you have reached the maximum point of recovery;

- for the first two years after the elimination period, keeps you from doing one or more, but not all, of the substantial duties of your occupation or results in the loss of 25 percent or more of the time spent by them in the usual daily performance of the duties of their own occupation; and

- after total disability and any partial disability benefits have been paid for two years, keeps you from doing one or more, but not all, of the substantial and material duties of any gainful occupation or results in the loss of 25 percent or more of the time spent by you in the usual daily performance of the duties of any gainful employment.

Do You See The Differences Between Residual Disability Benefits and Partial Disability Benefits?

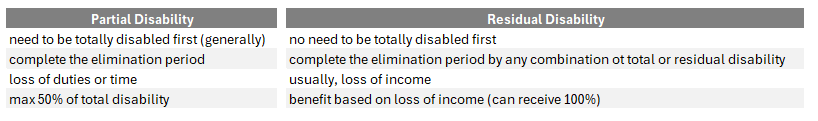

Do you see the differences between partial disability benefits and residual disability benefits? See the chart below.

If you had a policy with a partial disability provision without a residual disability provision, you could be in for a surprise when you make a claim.

Let’s use Joe again. Let’s say he had no residual disability provision in his disability insurance contract. As I mentioned, nearly all disability insurance companies have a partial disability provision as part of the policy. However, the definition can be stringent. Let’s use the definition (one that many companies use) in our section above.

Joe files a claim. Remember, he is working part-time. He is not totally disabled as of yet. He waits a few weeks and receives a letter from the company. It says they denied the claim because he isn’t totally disabled. So, Joe receives $0 from the company. Do you see how this works compared to the more favorable residual disability provision?

RA can be a long, debilitating disability. Same with multiple sclerosis and countless other illnesses or injuries. Depending on your situation and condition, it could be years before you are deemed totally disabled. You would receive $0 during this timeframe if you had a partial disability definition like this one.

Is that what you want?

That is why I consider the residual disability benefits rider an important component of disability insurance policies.

Residual Disability Benefits and Recovery Benefits

Many companies offer residual disability benefits. In recent years, however, these carriers have expanded their offerings to include additional options, such as recovery benefits.

Most companies now offer:

- basic residual disability rider (everything we talked about so far)

- enhanced residual disability rider (with recovery benefits) – same as the basic residual disability rider but has a recovery benefit.

Here is an example of a recovery benefit:

Upon return to full time employment, a recovery benefit will pay if you are working at least as many hours as had been worked prior to total disability, but you are earning at least 20% less than prior monthly income and meet the following conditions: You:

- are no longer disabled

- have returned to full time employment immediately after receiving disability benefits

- have a loss of monthly earnings equal to or greater than 20% of your monthly earnings

- can validate your recovery loss of monthly earnings is directly and solely due to their prior disability

The recovery benefit ends when you no longer have a loss of monthly earnings greater than 20% for any two consecutive months. We pay the recovery benefit for the lessor of six months or the remainder of the benefit period.

Note: when available and depending on the extra cost, an enhanced residual disability benefits rider provides more value. However, the basic residual disability benefits rider is still a solid option, especially for W-2 employees or other professionals whose salaries are fixed.

Cost of Residual Disability Benefits Rider

The cost of the residual disability benefits rider varies. It depends on:

- the disability insurance carrier

- your gender

- age

- income / salary

- occupation class

- the elimination and benefit period

- any adverse underwriting situations

However, to give you an idea of cost, here are a few examples:

A 40-year-old male, self-employed plumber who makes $80,000 could spend $24 per month on the residual disability benefits rider.

Conversely, a 25-year-old female RN who makes $80,000 could pay$17 per month.

A 50-year-old female accountant making $150,000 could spend $33 per month.

You can see that residual disability benefits rider might cost around $1 per day. Maybe cost more if you have a shorter elimination period and/or longer benefit period.

Can you see that $1 per day (more or less) is worth the cost to insure against a partial disability?

Final Thoughts About Residual Disability and Residual Disability Benefits

Residual disability benefits are a crucial component of comprehensive disability insurance policies. They provide essential support for individuals who experience a partial loss of income due to disability, allowing for a more nuanced approach to disability coverage. By understanding the concept of residual disability and its benefits, policyholders can better navigate their insurance options and ensure they have appropriate coverage for various disability scenarios.

Do you have residual disability benefits on your policy? Do you have disability insurance?

Contact us or use the form below. We would love to help you with this important coverage.

Remember, we only work in your best interests. That means we work for you and your family, not anyone else. If we can’t help you, we will point you in the right direction as best we can.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".