3 Important Health Insurance Options When You Lose Your Job | Coronavirus Or Anything Else

Updated: April 12, 2024 at 9:39 am

When you lose your job, you have to think about protecting your future in the short-term, and that includes options for health insurance.

When you lose your job, you have to think about protecting your future in the short-term, and that includes options for health insurance.

Sure, your first step is to file for unemployment.

After that, though, you need to protect you and your family from unexpected medical costs. You need to address health insurance options immediately. Health insurance is, after all, likely your next largest expense after your mortgage.

Don’t even think about going without. Holy cow; if you get sick with no health insurance, the financial pain could be bottomless.

Thankfully, there are a few options available. In my opinion, some options are better than others, but you have options.

At the time of this writing, many families are losing their health insurance from the impact of the Coronavirus. Too many websites are promoting fear during these stressful times. As always, we take a balanced approach. We always say that every insurance plan has advantages and disadvantages.

Here’s what we’ll talk about:

- COBRA

- Health Insurance Exchange Plans

- Short-Term Medical Insurance

- Comparison Of The Options

- Possible Health Insurance Premiums When You Lose Your Job

- Now You Know You Can Obtain Health Insurance If You Lose Your Job

Read on to learn about these options.

COBRA Coverage Is Always Available

COBRA – the Consolidated Omnibus Budget Reconciliation Act – allows you to continue with your group employer health insurance coverage upon a covered event. Job loss includes a covered event.

Employers with 20 or more employees must offer it. The industry calls this “COBRA” coverage or something similar. You are still on the same health insurance plan.

I’ve been on COBRA before. It is a nice option, especially if you like your group employer health insurance plan.

If you or a family member have a chronic condition, then the COBRA plan might be the way to go. Although, it doesn’t hurt to check out your other options.

However, you pay for it big time. Your employer doesn’t pay its share anymore – you are not employed – so you have to pay that. Then, you may have to pay an additional 2% fee for administrative costs.

In a nutshell, it can get really expensive.

On job loss, you can have COBRA for 18 months, whereupon you must be covered by another health insurance plan.

To switch out of COBRA and into another plan, you have two chances to do that. You can wait until November for the healthcare open enrollment, whereupon your effective date is 1/1 of ensuing year. Or, you can wait until the 18 months coverage is over. Just prior, you’ll receive notice of your coverage ending. This is a covered event to pivot to a healthcare exchange program.

Disadvantages Of COBRA Coverage

There’s one main disadvantage of COBRA coverage, and that is the cost. As mentioned, you will pay your employer’s share. Additionally, the carrier may charge a 2% administrative fee. COBRA coverage may be a very expensive health insurance option if you lose your job and money is tight.

Advantages Of COBRA Coverage

There are a couple of advantages of COBRA coverage.

The first is that COBRA coverage is the same plan as you had when you were working. It is the health insurance through your employer.

The second is if you have a pre-existing condition, your condition is still covered. This is important for many people and families who have moderate to severe health conditions.

Health Insurance Exchange Plans

Another option is a plan off the healthcare exchange. If you lose your job, you can purchase a health insurance plan off of your state’s health insurance marketplace/exchange. Every state has one.

Depending on the state, options might be very limited. Recall that these exchanges were created as part of the Affordable Care Act. (link)

Over the last several years, more carriers have dropped off the state exchanges because of the high cost of managing policyholders who have these policies. So, your options could be limited.

The good news is these plans, obviously, contain all the great protections of health insurance here in the US, specifically around pre-existing conditions.

However, they are extremely expensive. In times of job loss, do you want to spend a ton of money on health insurance? Maybe yes or maybe no. The right answer depends on your specific situation. And, I’ll get to that in a minute.

First, let’s talk about the disadvantages of these plans.

Disadvantages Of Health Insurance Exchange Plans

If you lose your job, you may feel obligated to continue through COBRA or purchase a plan off your state’s health insurance exchange.

These plans are expensive. Why?

Well, unlike a COBRA plan, these plans follow the ACA. That is great.

However, many people who enroll in these plans have moderate to severe health conditions. The great protection of the ACA allows these people to obtain the health services they need. They also, probably, receive a subsidy.

You, on the other hand, might be healthy. You probably won’t qualify for a subsidy yourself. Ultimately, your premiums are subsidizing this program for the people who have moderate to severe health conditions.

Again, we aren’t saying the ACA is bad. It is a great Act. However, it does have limitations. (Remember I said every insurance plan has advantages and disadvantages?)

If you are healthy, purchasing a health insurance plan off your state’s exchange may place more pressure on money. If you lose your job, do you want to spend a huge amount of money on an expensive health insurance plan?

Maybe…it depends if an exchange plan holds an advantage for you. Let’s talk about the advantages next.

Advantages Of Health Insurance Exchange Plans

There’s a clear advantage of purchasing a plan off your state’s health insurance exchange.

If you have a moderate to serious health condition, that condition is covered.

What better peace-of-mind is there?

That is one of the great protections of the Affordable Care Act.

However, as we said, you may be healthy and not able to (or don’t want to) afford this kind of health insurance plan, especially upon a job loss.

Let’s talk about a more affordable option next.

Short-Term Medical Insurance

Short-term medical or health insurance plans are an option if you lose your job. These plans are not perfect, by any means, but they are an option.

Too many people and websites are not giving short-term medical plans a balanced approach. Even other CFP®/Financial Professionals (I am one) are saying to avoid short-term medical plans at all costs. That is not the right advice. What if this is your only option? What do you do? Too many people are disparaging these plans when they can work temporarily.

Moreover, contrary to what you have read, these carriers are covering COVID-19 testing.

They aren’t perfect, for sure. Heck, even I describe them as “buyer beware” on a recent article about short-term medical plans. (I focused on the limitations on these plans).

However, they do and can work. Like anything else, you must know the limitations.

Short-term medical insurance plans have the same look and feel as your group employer coverage. You’ll have a deductible, copay, and coinsurance.

You must pay the deductible first before the insurance covers.

Most short-term medical plans utilize doctor networks such as Aetna and Cigna. These are NOT Aetna or Cigna health insurance plans. The short-term medical plan simply uses the doctor networks.

They’ll cover you if you are diagnosed with a sudden illness such as cancer. Or, if you get an injury and need hospitalization.

And, these conditions will be covered until the short-term medical insurance ends.

You probably don’t know what that means. So, this is a great time to discuss the disadvantages of short-term medical plans.

Disadvantages Of Short-Term Medical Insurance

There are several disadvantages of short-term medical plans. The reason why they exist is because short-term medical plans are designed for the short-term. It is temporary coverage to protect you for worst case – for example a job loss – until you can pivot to a new employer plan or find better coverage.

So, these plans aren’t going to cover everything.

They don’t have the great protection of the ACA, namely around pre-existing conditions and important wellness benefits.

They also don’t typically cover the following:

- Preventative care/wellness checkups like physicals

- Pre-existing conditions

- Prescriptions drugs insurance (although a majority include a drug discount card which works well in most cases)

- Pregnancy costs

Why? Again, these are plans are designed for the short-term.

The carriers here are expecting you to move to a group employer plan in the near future.

Unlike an ACA plan, these plans require underwriting. Underwriting usually consists of answering a health questionnaire. These carriers aren’t going to approve you if you’ve had a chronic condition like type 2 diabetes.

They are not designed for long-term coverage.

Having said that, there are advantages as well.

Advantages Of Short-Term Medical Insurance

The first advantage is these plans are much less expensive. The reason why is that they are not ACA compliant.

The can help when there is budgetary pressure when you and your family need the money the most.

Additionally, they are flexible where, depending on the state, you can purchase additional coverage, if needed. For example, you can purchase a preventative care insurance plan

However, keep in mind, these plans are NOT designed to be held long-term. They are designed for temporary health and medical protection should something happen to you.

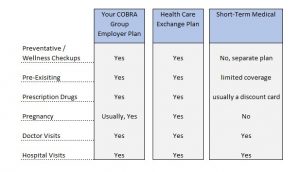

Comparison Of Health Insurance Options If You Lose Your Job

Here’s an illustration of the differences and similarities of the 3 health insurance options if you lose your job.

As we said before, there are advantages and disadvantages to each one.

Premium Cost Comparison Of Health Insurance Options When You Lose Your Job

If you look at the above illustration, you’ll think, “yes, I need COBRA or a health insurance exchange plan“. And, maybe you do. However, as we mentioned before, you’ll pay for it. In a time of a job loss, do you want to spend a lot of money? Most people don’t. They want to conserve money as much as they can if they lose their job.

So, I looked at the possible premiums available for comparison purposes. I assumed a couple age 40 with 2 children aged 10. Of course, premiums depend on the state where you live.

I arbitrarily selected several health insurance exchange plans and short-term medical plans. Note: $0 deductible plans are rare.

As you can see, however, a short-term medical plan can work provided you understand the limitations. I do not recommend if you have a serious medical condition as the condition likely won’t be covered.

Nevertheless, you might be able to save between $500 and $1,000 per month on premiums alone. If you are only needing this for a few months, a short-term medical plan can be a viable option.

Now You Know You Have Health Insurance Options If You Lose Your Job

If you lose your job, now you know you have health insurance options. The right one really depends on your specific situation. If you like your employer plan, you can always continue with COBRA. Insurance plans off your state’s insurance exchange are available.

However, you’ll pay for these in a major way. Do you want to spend a lot of money on health insurance if you lose your job? Having money available is a major factor when you don’t have a job. If you have a chronic condition or a severe ailment, then a COBRA plan or an ACA exchange plan might be your best choice.

However, if not, short-term medical plans are available. You can save a lot more money and still maintain protection if something were to happen to you or your family. These plans don’t cover everything and not designed for long-term needs. But, they can work well as a temporary health insurance solution.

Which is right for you? Contact us or use the form below. There is no risk to contact us. Why? Because we have fiduciary duty to work in your best interest only. That means we put your needs first, not another carrier’s and certainly not our own. We can definitely help you determine which option is right for you.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".