Mistakes When Signing Up For Medicare Part B

Updated: April 12, 2024 at 9:39 am

Every day, thousands of Medicare-age beneficiaries are facing a decision. The decision is when to sign up for Part B. Not knowing when or signing up too late could have costly consequences. Those consequences hit you in your wallet or purse. For life. You don’t want that to happen, do you? In this article, we discuss the Part B enrollment periods and mistakes when signing up for Medicare Part B. First, we discuss when to enroll in Part B.

Every day, thousands of Medicare-age beneficiaries are facing a decision. The decision is when to sign up for Part B. Not knowing when or signing up too late could have costly consequences. Those consequences hit you in your wallet or purse. For life. You don’t want that to happen, do you? In this article, we discuss the Part B enrollment periods and mistakes when signing up for Medicare Part B. First, we discuss when to enroll in Part B.

When To Enroll In Medicare Part B?

You are probably not aware, but the government requires you to enroll in Medicare. I suppose you can avoid this and work full-time for the rest of your life, but that is nearly impossible. Moreover, compared to traditional health insurance, Medicare usually costs lower and has lower out-of-pocket expenses. However, your specific situation dictates.

The required age to sign up for Medicare Part A and Part B is age 65. You know that. Most people sign up for Medicare Part A at age 65 because Part A is “free”. (Not necessarily – you paid for Part A during your working life through the Medicare payroll tax.) But, going forward, you don’t pay any more for Part A. (Unless you have to pay for Part A, which is out of the scope for this article.)

The confusing part is when to enroll in Medicare Part B. You have two options. Enroll at 65 or delay after age 65.

Enroll In Medicare Part B At Age 65

The easiest thing to do is enroll at age 65. You can do this 3 months before you turn age 65. You can sign up for Medicare Part A at this time, too. (Note: you can, in fact, delay Part A as well. This can be advantageous if you are contributing to a health savings account. But most people sign up for Medicare Part A during this 3-month window.)

When you enroll in Medicare at age 65, your age 65 birth month is your eligibility month. Technically, you have a 7-month window to sign up for Medicare Parts A & B: 3 months before your month of age 65, the month you turn age 65, and 3 months after age 65. (If you sign up after your eligibility month, your Medicare coverage could be delayed. We discuss that later.)

When you sign up for Part B at age 65, this starts another enrollment period for you. You can enroll in Part C (Medicare Advantage) or Part D (Medicare Prescription Drug Plans) That enrollment period is:

-3 months before your eligibility month,

-your eligibility month (the month you turn 65), and

-3 months after your eligibility month

Added together, this is a 7-month enrollment period to sign up for Part C (Medicare Advantage) or Part D (Medicare Prescription Drug Plan).

In case you are wondering, yes. Your enrollment period for Parts A and B (7 months) matches that of signing up for Parts C and D (7 months). Technically speaking, this period is your initial enrollment period (IEP) for Parts A and B and your initial coverage election period (ICEP) for Part C or your initial enrollment period (IEP) for Part D. Confused?

Medicare Supplement Enrollment

If you want a Medicare Supplement plan, your enrollment period starts on your eligibility month. That is, when you are age 65 and have enrolled in Part B. It lasts an additional 5 months (6 months in total). It is very important to sign up during this timeframe as this period excludes any underwriting for pre-existing conditions.

If you don’t sign up for Medicare Parts A and B when first eligible, you may face a lifetime penalty. More on that later.

If you are still working, under group coverage, and want to join Medicare, you need to consult your HR/benefits department first. They will let you know how your group employer coverage coordinates with Medicare. More on that below.

Enroll In Medicare Part B After Age 65

If you or your spouse is still working and under group employer coverage, you can delay your Part B enrollment (usually, in most cases. More on that below). When you delay Part B, you usually qualify for a special enrollment period. That special enrollment period means you can sign up for Part B (and Medicare Part A, too, if you did not already).

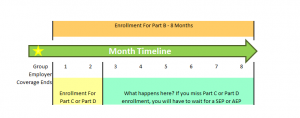

This special enrollment period (SEP) to sign up for Part B begins the month after your employment ends (i.e. you retire) or the group coverage ends, whichever comes first and lasts for 8 months (Wow!). Note: you can, at age 65, drop your employer coverage and enroll in Medicare while still working.

For example, you decide to end your group coverage on January 31. (After notifying your employer and social security, of course). Your special enrollment period to sign up for Medicare Part B is from February to September (8 months). It is important to sign up for Part B (and Part A if you did not already) as soon as possible so there is no gap in medical coverage. Ideally, in our example, you would want your Part B to start February.

However, the enrollment period for Medicare Part C (Medicare Advantage) differs after age 65. Your enrollment period is the 2 month period after the month your employer coverage ends.

Wondering about your Part D enrollment period? Luckily, the enrollment period is the same. Your enrollment period is the 2 month period after the month your employer coverage ends.

Example of Medicare Advantage Plan or Prescription Drug Plan Enrollment Over Age 65

For example, let’s continue with the example above. Your Part B effective month is February. If your employer coverage ended January 31, your enrollment period is February and March. What does this mean? It means you really need to get on it if you want a Medicare Advantage plan so your coverage line up. As soon as you know when you want to retire or end your coverage, you need to pick that Part B month. Then, when you get your Medicare card in the mail, you can enroll in a Medicare Advantage in that 2-month window.

The same is true for enrollment in a Part D plan.

You can see there is a tight window to enroll, as we illustrate below.

If you are wondering about a Medicare Supplement plan, your enrollment period is the same. It is the 6-month period starting when you are age 65 or over and have Medicare Part B.

Mistakes Made When Signing Up For Medicare Part B

Did you get all of that? Wow, so many enrollment periods. Now, you may be wondering about these mistakes, right?

Yes, John, tell me about these mistakes made when signing up for Medicare Part B, you ask.

Well, here’s a question: When do people make these mistakes? Here is a hint: we just went over them.

Their enrollment periods, you ask?

Yes!

You can see how confusing it can be. There are so many enrollment periods to remember. Moreover, there could be other outside factors which cause you to miss a critical enrollment period. We discuss all of these situations next.

Mistake # 1 – You Simply Don’t Sign Up At Age 65

Remember we said signing up at age 65 is a requirement. It is a requirement because, in order for Medicare to “work” (we put “work in quotations because as a government entitlement program, it works pretty well in our opinion), the risk pool includes all eligible beneficiaries. The more people in the pool, the lower the risk among the participants in the pool. By spreading the risk, Medicare hopes to keep premiums low.

There are really two times you should sign up for Part B: at age 65 or at a later age when coming off of employer coverage, assuming your employer has more than 20 employees. More on that in a minute.

But, that is it. If you can remember that, you should be in good shape.

Let’s say you miss signing up for Medicare Part B (and Part A, for that matter) at age 65 (remember, this is your initial election period). You aren’t working. No one told you that you needed to sign up. If you miss that 7-month window to enroll in Medicare Part B, you will have to wait. And, likely face a lifetime penalty.

Did you say, ‘lifetime’, John, you ask?

Yes.

Assuming you don’t have proper employer coverage, you can sign up for Part B during the General Enrollment Period (GEP). The GEP starts January 1 and goes all the way to March 31. You can sign up anytime for Part B within this timeframe. However, your Medicare Part B effective month will be July (July 1, to be exact).

Can you see the gap? This is dangerous and where many beneficiaries get themselves in trouble.

Penalties Galore

What is the penalty? It is:

every 12 month period you miss X 10% X current base Medicare Part B monthly premium

So, if you miss 12 months and the Part B monthly premium is $140, you will owe an additional $14 per month (1 yr X $140 X 10%). If the Medicare Part B premium increases to $200 next year, you will have to pay $20.

The penalties do not stop there. If you miss your Part B enrollment at age 65, you likely miss your Medicare Part D enrollment as well, unless you have creditable coverage. What is creditable coverage? It is prescription drug coverage that meets the minimum Medicare prescription drug requirements. You can have creditable coverage from the following ways:

(1) employer / union drug coverage

(2) Veteran’s Affairs coverage

(3) Anywhere else which meets Medicare’s minimum requirements

If you go without creditable coverage for more than 63 days, you will have to pay a Part D penalty as well. That penalty is:

1% X the current “national base beneficiary premium” (in other words, national average) X the number of uncovered months

Medicare rounds the result to the nearest $0.10 and adds to your Part D premium.

For example, if the national base beneficiary premium is $35.00, and you miss 7 months, the penalty is 1% X $35.00 X 7 months = $2.45/month. It is rounded to $2.50.

Like the Part B penalty, the Part D penalty changes every year from the changes in the base premiums. And, the Part D penalty lasts your lifetime, too.

Mistake #2 – You Think You Have The Right Employer Coverage

Generally speaking, if you have group employer health coverage, you can delay your Part B enrollment until a later day. You must continue to actively work, to0. There is a “however” (of course). In fact, this is a big “HOWEVER”.

In order to compliantly delay your Part B enrollment, your employer must have more than 20 employees. You see, Medicare is primary for employees who work at a company with fewer than 20 employees.

If you work at a company with more than 20 employees, Medicare is secondary. Your company’s coverage is primary. Therefore, you can delay your Part B enrollment.

According to the SBA, there are 20,000,000 people who work for an employer with fewer than 20 employees. Let’s assume that 20% of these are age 65. That’s 4,000,000 people who could make a long-term mistake.

And, while we are at it, yes, you can delay your Part B enrollment if you are covered under your spouse’s employer health insurance. However, the same rules apply.

Just think how awful the conversation will be if you BOTH are charged a penalty because you thought you could delay signing up for Medicare Part B.

In our experience, these penalties can be much steeper because of the time span involved. You may inadvertently delay your Part B enrollment 3 or 4 years. If you delay your Part B enrollment by 4 years, that could mean a significant penalty. (At 4 years X 10% X $140…yikes!) Tack on a Part D enrollment penalty, and you could be paying an additional $50 or more per month.

The moral of the story: find out from your employer how your (or your spouse’s) group coverage coordinates with Medicare. That is all you need to ask and HR/benefits will tell you.

Mistake #3 – The Retiree Coverage Or COBRA Coverage Mirage

Many companies offer their retirees health insurance coverage. You meet certain time of service or other qualifications. In return, the company offers discounted or expanded coverage. Retiree coverage usually mimics a Medicare Supplement plan – it picks up the cost where Part A doesn’t.

You may know that in order to obtain a Medicare Supplement plan (or a Medicare Advantage plan), you must enroll in Medicare Part B first. The same is true for the retiree coverage. You see, you are no longer actively at work, so you are no longer under group employer coverage. Medicare becomes primary and your retiree coverage picks up the cost (depending on your plan – as always, it is a good idea to compare your retiree coverage to other options) where Medicare does not.

The same holds true for COBRA. Let’s say your spouse separates from employer coverage at age 63.5. COBRA laws state that coverage amounts for employees are 18 months and spouses-dependents are 36 months when separated from service. Coincidentally, your spouse signs up for Medicare Part B at age 65 because his COBRA time period ended. You are age 67 and ready to enroll in Part B since your 36 month time period for COBRA is coming to an end. What happens? You are penalized two years worth because you did not sign up for Medicare Part B at age 65. You will have to enroll in Medicare Part B during the GEP. Remember the GEP starts January 1 and runs through March 31. Your effective month is July. A potentially huge and expensive coverage gap exists. Moreover, you will likely have a penalty for Medicare Part D as well.

What To Do If You Miss Signing Up For Medicare Part B

If you miss signing up for Medicare Part B, you must sign up at your first, subsequent opportunity. Penalties simply grow and expand. Stop the bleeding and enroll at your next opportunity.

Two situations exist where you can enroll in Part B if you missed your initial enrollment period.

The General Enrollment Period – this enrollment period lasts from January 1 to March 31. If you missed signing up for Medicare Part B, you can sign up during this timeframe. July is your effective start month.

A Special Enrollment Period – numerous situations exist that allow beneficiaries to move between plans, drop a plan, or add a plan. One that we discussed is the SEP in which you leave group employer coverage.

Depending on the situation, you may or may not face a penalty.

Conclusion

Do you see how mistakes are made when signing up for Medicare Part B? As we stated, you have two opportunities to enroll in Part B without penalty. They are at age 65 or when leaving proper group employer coverage. If you enroll during one of these times, you should be fine.

Are you still confused? Do you need our assistance? We would be more than happy to help you navigate these decisions. You aren’t alone. Feel free to contact us or use the form below. As always, we only work in your best interest. It is the only way we know how to work with our clients.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".

2 thoughts on “Mistakes When Signing Up For Medicare Part B”

Comments are closed.

I really appreciate your advice for ensuring part B sign up at the age of 65. I did not know that you could miss the timeframe and thus be ineligible. I am looking to help my mother figure all this stuff out as she is almost eligible. I hope we can find the right Medicare coverage for her so she can afford her medical expenses.

Hi Greta,

Thanks for your comment. We can help your mother. We will send you an email with more information. I would caution that there are likely many options for your mother and that she should identify her current and future needs.

John