Your Do Over: The Medicare Advantage Open Enrollment Period (MAOEP) | Understand Your Options So You Can Maximize Your Plan

Updated: April 12, 2024 at 9:39 am

If you have a Medicare Advantage plan, you may have heard of the Medicare Advantage Open Enrollment Period (MAOEP).

If you have a Medicare Advantage plan, you may have heard of the Medicare Advantage Open Enrollment Period (MAOEP).

Nope. It’s not the Annual Open Enrollment Period.

The MAOEP starts January 1st and runs until March 31st.

It is during this time you can disenroll from your Medicare Advantage plan.

Why would you want to do this? We will get to that. You’ll want to think of the MAOEP as your “do over”.

In this article, we discuss the Medicare Advantage Open Enrollment Period and how to maximize your Medicare options should you decide to “do over”.

Why Does The Medicare Advantage Open Enrollment Period Exist?

Here’s why.

Let’s say you enroll in a Medicare Advantage plan, maybe during OEP. You use  the plan, and things aren’t working out tight. Maybe:

the plan, and things aren’t working out tight. Maybe:

- your doctor is not in the network

- it’s a limited doctor network for your area

- you were misled on how the plan works

- you just messed up and thought it was a Medicare Supplement plan

So, during this 3-month window, you can:

- switch from your Medicare Advantage plan to another Medicare Advantage plan, or

- drop the Medicare Advantage plan, return to Original Medicare, and enroll in a Part D prescription plan. You’ll want to enroll in a Medicare Supplement plan as well

That’s why we say the MAOEP is like a “do-over”.

The Medicare Advantage Open Enrollment Period proves useful in these situations as well:

- you missed your chance during AEP/OEP (annual open enrollment period) to make changes

- you received your carrier’s Evidence of Coverage and want to make a change

- your plan no longer covers a prescription drug (or cost increased)

- your doctor is no longer in the MA network

- you don’t like the referral process or the administration of the MA plan

The MAOEP gives beneficiaries a chance to start over. As we said before, think of it as a “do over”.

This period is only for beneficiaries who have a Medicare Advantage plan and want to make a change.

That means if you have a Medicare Supplement and/or a Part D plan, you can’t make a change. Sorry – that’s just the law.

New Enrollment Options If You Want To Switch During The Medicare Advantage Open Enrollment Period

If you disenroll from your Medicare Advantage plan during this timeframe, you will be re-enrolled into Original Medicare (Parts A & B). If you have read our other articles on Medicare, you know that Original Medicare exposes you to unlimited out-of-pocket costs. Generally speaking, you want to avoid any chance of having unlimited out-of-pocket cost potential.

There are good news, however. During this timeframe, however, you can enroll in a Medicare Supplement plan as well as a part D Medicare prescription drug plan. You have to enroll in the part D Medicare prescription drug plan by February 14th.

Don’t put that off, though. You will want to enroll in a part D Medicare prescription drug plan as soon as possible to avoid any enrollment penalties due a creditable coverage gap. This gap is 63 days. After 63 days, you will pay the penalty upon enrollment in a part D plan.

You can enroll in the Medicare Supplement plan anytime, but we recommend as soon as possible to minimize any significant out-of-pocket costs.

By enrolling in a Medicare Supplement plan and a part D Medicare prescription drug plan, you will have limited out-of-pocket costs depending upon the plan you select.

Be Aware

When you disenroll from your Medicare Advantage plan, you will disenroll from any other services attached to your Medicare Advantage plan. This includes the prescription drug component as well as value-added services such as fitness benefits, dental, and vision. Be aware of this.

What You Can’t Do

There are some things you can’t do. You can’t switch from Original Medicare to a Medicare Advantage Plan. Additionally, you can’t switch from your Medicare Advantage plan to another Medicare Advantage plan. (That is what the annual enrollment period, AEP, is for.) Finally, you can’t switch from a part D Medicare prescription drug plan to another part D Medicare prescription drug plan. (Again, that is what AEP is for.)

You can ONLY drop your Medicare Advantage plan, which places you back into Original Medicare, and select a part D Medicare prescription drug plan and / or a Medicare Supplement plan.

Do Affordable Options Exist?

You may be thinking, “John, this stinks. I signed up for my Medicare Advantage plan because it was a low premium cost. I would like another low cost option.”

You are thinking right. Depending on the Medicare Supplement plan type and your state, you could end up over $200 per month for a Medicare Supplement plan. Additionally, a part D Medicare prescription drug plan, on average, costs around $35 per month. You will then be paying around $235 per month when you were paying, probably, anywhere between $30 and $50 per month for your Medicare Advantage plan. (In some cases, Medicare Advantage plans have a $0 premium.)

You have affordable options, and we discuss those next.

Affordable Plan Options If You Make A Change During The Medicare Advantage Open Enrollment Period

You have options, but the way I see it, you have two affordable options. We discuss these next.

Low Premium Or $0 Premium Medicare Advantage Plans

Medicare Advantage plans operate like employer major medical. However, these Medicare Advantage plans have fewer out of pocket costs and copays. For instance, many of these plans have out-of-pocket limits of $6,700 annually.

Recently, many carriers have introduced low-premium or $0 premium Medicare Advantage plans. You still have out-of-pocket costs. Years ago, low or $0 premium plans subjected you to high out-of-pocket costs. Not really anymore. It’s a competitive market. You will want to make sure your doctor and hospitals are in the carrier’s networks. Moreover, you will want to make sure you have savings to pay for some of these out-of-pocket costs. (Related: see our article on mistakes when purchasing a 5-Star Medicare Advantage plan.)

However, these low premium or $0 premium Medicare Advantage plans are not as bad as what other agents make them out to be. You just need to know the limitations and disadvantages of each.

Affordable Medicare Supplement Plans

If you have been a Medicare beneficiary for awhile, you know you can still purchase Plan F.

Plan F is the Cadillac plan, for sure. It will cover nearly all of your Medicare out-of-pocket costs.

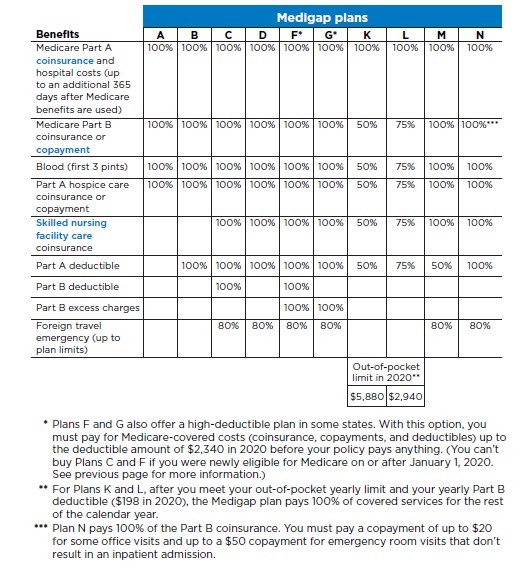

However, do you need Plan F still? See the diagram below.

New Medicare laws limit Plan F sales. The main difference between Plan F and other plans (except Plan C) is Plan F covers the Part B deductible (and some other services, too).

New Medicare laws limit Plan F sales. The main difference between Plan F and other plans (except Plan C) is Plan F covers the Part B deductible (and some other services, too).

Do you need Plan F to pay the Part B deductible? Likely not. You might be overpaying for your Medicare Supplement to pay for Part B deductible.

We will show you what we mean with an example.

Example Of Other Medicare Supplement Options

The Part B deductible for 2020 is about $203 for the whole year.

Let’s say a 70 year old male, non-smoker, wants to switch to a Medicare Supplement. Because he is a current Medicare beneficiary, he can purchase Plan F.

Plan F, depending on the carrier, costs between $185 and $225 per month.

Plan G, on the other hand, costs between $130 and $180 per month.

Do you see how Plan G would save you more money? You could save almost $1,150 annually and have enough money to pay for that $203 Part B deductible.

Can you do better? Sure.

Look above at Plan N. The big difference here is you’d pay a copay for doctor visits.

How often do you go to the doctor?

Plan N might cost between $120 and $140 per month. This means you might save almost $1,300 on premiums alone. You’d still have enough money to pay for the Part B deductible and any doctor copays.

Does this make sense?

There are even more affordable options. Just depends on how much costs you want to front. We talk about the high deductible options next.

Why A High Deductible Medicare Supplement Plan Is A Good Option During The Medicare Advantage Open Enrollment Period (MAOEP)

There is another affordable option available to you, though. Look at the chart above. You might be aware that Plan F offers the most coverage on your out-of-pocket costs. You may not know, however, that most states allow a high deductible Plan F.

Just how it sounds, you would have to meet the deductible first before enjoying the Plan F coverage benefits. The deductible level in 2020 is $2,340.

The premium cost of these plans is around $60 to $70 per month, maybe higher or lower depending on your state. Add your part D prescription drug plan of $35 per month, on average, you have an estimated total cost of around $105 per month.

But, John. I don’t want to pay $2,340 right off the bat, you say. That is a great point. You actually won’t. Remember, in an Original Medicare and Medicare Supplement arrangement, your doctor or hospital will bill Original Medicare first. Original Medicare will pay for its appropriate share. Your Medicare Supplement plan will then pay the remaining balance. However, in this case, the high deductible plan will pay once you meet that deductible threshold. Let’s look at an example to make this clear.

Example Of The High Deductible Medicare Supplement Plan F

Using Part B services as an example, let’s say you go to the doctor because of knee pain. This is your first doctor or hospital visit of the year. The office charge is $350 dollars – the Medicare approved amount. Per Original Medicare, you have to pay the part B deductible first of $203. Medicare will then pay 80% of the remaining amount or $117.60. The amount you need to pay and applied to your high deductible Plan F is $232.40 ($203 + $29.40)

Let’s say the doctor recommends knee surgery. The Medicare cost is $11,000. Medicare will pay $8,800 ($11,000 X 80% – Remember, you already met the part B deductible of $203). The Medicare Supplement share is $2,200. You would only pay $2,107.60 as you now met the deductible level of $2,340 ($2,107.60 + the $232.40 you paid earlier). The balance of $92.40 ($2,200 – $2,107.60) will be paid by the Medicare Supplement plan.

The above example was used for illustrative purposes only. The Medicare Supplement plan now pays for its share of eligible Medicare services going forward for the rest of the year. You don’t pay for anything.

Medicare still pays its share, and you won’t have extreme out-of-pocket exposure. You will still have peace of mind knowing you have great coverage in case of large health care expenses.

The Math Works

The premium cost of a Plan F is around $200 per month. This amount varies by state. Let’s say the average high deductible plan F costs $65 per month. That is a difference of $135 per month or $1,620 annually.

You have to ask yourself…is it worth your hard earn money to spend an additional $1,620 to protect $2,340 of deductible? For many, the answer is “No”.

That is why a high deductible Plan F makes sense. In nearly all cases, you are spending that amount in premiums on a Plan F.

Moreover, one carrier analyzed its claims on Plan F – both high deductible and regular Plan F. They determined that between 70% and 80% the total claims paid by their Plan Fs was anywhere from $500 to $800 per year. The probability increased with age, naturally.

So, stated another way, is it worth your hard money to spend $200 per month or $2,400 annually, when, on average, Plan F claims (paid by one large carrier) averaged between $500 and $800 per year? For most of us, the answer is No.

Now You Know The Medicare Advantage Open Enrollment Period And The Options That Exist

If you don’t like your Medicare Advantage plan, you can “do over” during MAOEP – the Medicare Advantage Open Enrollment Period.

As we outlined above, you can still create an affordable Medicare health insurance plan using another Medicare Advantage plan or an affordable Medicare Supplement plan such as a high deductible Part F plan.

Is disenrolling the right decision for you? We can help determine that. We only work with your best interests and making sure you make the right decision for you and your family. Unlike other agents or agencies, we aren’t beholden to an insurance company. Rather, we are beholden to you. Contact us or use the form below if you would like to learn more about the Medicare Advantage open enrollment period (MAOEP) and affordable Medicare insurance options.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".