How To Save Money On Your Medicare Part D Cost [Top 4 Ways And Be Worry-Free!]

Updated: April 12, 2024 at 9:40 am

Do you want to save money on your Medicare Part D cost? Who doesn’t, right?

Do you want to save money on your Medicare Part D cost? Who doesn’t, right?

Prescription drug costs have gotten out-of-hand. While you know that, did you know premiums are increasing, too? Before you know it, you are going to end up in the dreaded Medicare Part D “donut hole”. Trust us; you don’t want to be there. It’s not a tasty place.

Thankfully, there are ways to mitigate your Medicare Part D cost and avoid this donut hole. We talk about the ways in this article.

- Elements That Comprise Of Part D

- What Is The Donut Hole

- 4 Ways To Save Money On Medicare Part D

- Now You Know How To Save On Your Medicare Part D Cost

Let’s start off with an understanding of the elements that make up the Medicare Part D cost structure. Even if you aren’t new to Medicare, this will be a good review.

What Elements Comprise The Medicare Part D Cost?

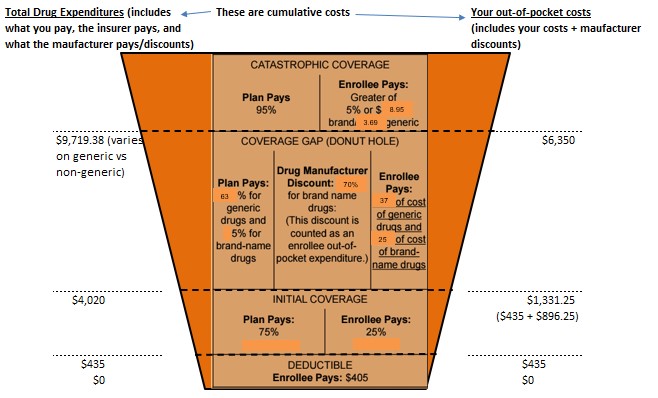

This is a question many new and current Medicare beneficiaries ask. As you can see from the diagram below, your Medicare Part D prescription drugs cost is structured in 5 different ways. Know these ways, and how they interact, and you’ll save money on your Medicare Part D prescription drug cost. I can guarantee that.

#1 The Deductible

If your plan has one, you pay this amount 100% before the insurance pays its share.

Years go, deductibles were common on all plans. However, nowadays, many plans have only a deductible on tier 3 through 5 drugs (brand and specialty drugs). Moreover, some plans have $0 deductibles! That means your Medicare Part D prescription cost is covered day 1. How great is that?

If you have a plan that requires you to pay the full deductible on tiers 1 through 5, you should consider changing plans. Many plans have removed full deductible plans unless they have a very competitive premium. We discuss this more later.

#2 Initial Coverage

Once you paid your share of the deductible (if your plan has one), you will enter the initial coverage stage. In this stage, you will typically pay a low (or no) copayment for generic drugs and a higher amount for brand and specialty drugs. You will pay less if your pharmacy is a preferred network pharmacy. We can’t stress enough that your pharmacy needs to be in a preferred network in order to maximize drug savings.

#3 Medicare Part D Donut Hole

Once the total Medicare part D prescription drug costs reach $4,020 (in 2020), you will enter the coverage gap (“donut hole”). Here, you will pay a higher share of generic and brand drugs.

You may have heard about the “donut hole” before. It is not as dreaded as it used to be, thanks to the passage of the Affordable Care Act. However, if you end up here, you’ll face sticker shock for sure.

#4 Catastrophic Coverage

Upon your out-of-pocket Medicare part D prescription drug costs of $6,350, you will enter catastrophic coverage. Here, you will generally pay the greater of 5% coinsurance or a $3.69 copay for generic drugs and the greater of 5% coinsurance or a $8.95 copay for brand and specialty drugs.

#5 The Premium

Finally, to have all of this, you need to pay the premium. The average Part D premium in 2020 is expected at $42 per month, according to the Kaiser Family Foundation.

How Does The Donut Hole Relate To The Medicare Part D Cost?

As we mentioned, the “donut hole” in part D Medicare prescription drug plans is the coverage gap where you have to pay more of your share of prescription drug costs. You enter the “donut hole”, formally called the Medicare coverage gap, when the total part D Medicare prescription drug costs reach $4.020 (in 2020). This total includes what you pay, what your drug plan covers, and any manufacturer discounts. (It does not include your monthly premiums.) See the diagram above for a depiction.

In our view, the “donut hole” refers to the “no man’s land” of part D Medicare prescription drug costs where you need to pay more of your share. Your out-of-pocket costs are much higher if you enter the “donut hole”.

In 2020, your maximum costs for your Medicare part D prescription drugs is 37% of the cost for generics and 25% of the cost for brand drugs. We will discuss further why we state “maximum” below.

Once you reach $6,350 (in 2020) of your personal, out-of-pocket costs (see right column above) with Medicare part D drug costs, you will enter the more favorable catastrophic coverage. However, as you can tell, you will personally spend a lot of money to get there.

What Costs Are Included In the Medicare Part D Donut Hole (Medicare Coverage Gap)?

As we mentioned, but it bears repeating, the following contribute to you moving through the coverage gap (“donut hole”):

- your share of the prescription drug costs (highest)

- any third party made on your behalf

- manufacturer discounts

- Medicare/your plan’s share

Excluded costs include:

- your premiums – you always have to pay

- any over the counter drugs or vitamins

- free samples provided by your doctor

- drugs purchased outside of your part d prescription drug network

How To Save Money On Your Medicare Part D Cost

Now that you have an awareness of how the “donut hole” / Medicare coverage gap works, we can illustrate some of the ways you can save money on your Medicare Part D cost. Review the diagram above. Your goal is to stay in the initial coverage stage at all possible.

This means working with your doctor and selecting generic medication first before trying brand or specialty drugs.

#1 – Analyze Your Situation

If you are still working, near age 65, or older than 65 and still working, you have the prime opportunity to start analyzing your situation now. At some point, you will need Medicare. (Unless your company offers a retiree health plan and you enroll in that.) Do you take any generic drugs? Any brand drugs? While it is not 100% certain, hereditary conditions can inflict you. Are your parents or other family members take any generic or specialty drugs?

By analyzing your situation now, you can get a head start on how to manage your part D prescription drug costs.

Additionally every OEP, you should review your prescription drugs and see who is the lowest cost plan in your area. This is particularly important if your prescription drugs changed during the year.

#2 – Shop The Carriers…

The Medicare part D prescription drug market is very competitive. Carriers are wanting your business. They have developed certain formularies and pricing to attract certain Medicare beneficiaries.

Every year, the carrier rates change. Some go up, others go down. Carriers add drugs to their formularies. Some drugs change tier levels. Additionally, your own situation might change. Maybe you now need a specialty drug instead of a generic. Or, your doctor has put you on a generic instead of the brand drug. It is worth the time to shop and make sure you are receiving the best plan for your situation.

Additionally, some part D prescription drug carriers offer plans that help Medicare beneficiaries save money through the Medicare part D donut hole.

Medicare.gov offers a nice part D prescription drug cost estimator. Just input your prescription drugs and frequency, and the website will return the plans by cost in your area. It is always best to confirm the information those plans are indeed the lowest or meet your needs.

#3 – …And Make Sure Your Pharmacy Is A Preferred Pharmacy

Preferred pharmacies receive the best cost-sharing opportunity for you. In many cases, preferred pharmacies have options for mail-order drugs which usually come with a $0 copay. If you regularly take a prescription drug (a maintenance drug), a mail-order option could save you quite a bit of money. It pays to ensure your pharmacy is a preferred pharmacy. If not, then consider switching.

#4 – Research Manufacturer Discounts…And State Pharmaceutical Assistance

For certain brand and specialty drugs, a manufacturer may offer a discount for you. Sometimes, the drug could be free after their discount.

Additionally, many states offer pharmaceutical assistance to help residents pay for drug costs. For example, Massachusetts offers a nice assistance program for beneficiaries who qualify. Usually, assistance is based on a chronic condition and/or income levels. It is worth to check out if you feel you may qualify for assistance.

Now You Know How To Save Money On Your Medicare Part D Cost!

Now you know how to save on Medicare Part D cost. We outlined ways you can save. Do you know what you need to do next? We work with nearly all of the major prescription part D Medicare carriers. We can help determine what will not work and what could work in your situation as we have done for many Medicare beneficiaries. Contact us for help or use the form below.

There’s no risk of contacting us. Why? We only work in your best interest. If we can’t help you out, you’ve learned a little more, and we’ll part as friends. Really, it’s that simple. That’s how important we treat you.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".

2 thoughts on “How To Save Money On Your Medicare Part D Cost [Top 4 Ways And Be Worry-Free!]”

Comments are closed.

Excellent post. I was checking continuously this blog and I am impressed!

Very helpful info specially the last part 🙂 I care for such information a lot.

Thanks, Donna. Let us know if you need our assistance. Be glad to help any way we can.

John