How To Prevent Medicare Observation Status [Know How To Get Around This And Save Money]

Updated: April 12, 2024 at 9:40 am

Ask any Medicare beneficiary about observation status, and you’ll likely receive a four-letter word response.

Ask any Medicare beneficiary about observation status, and you’ll likely receive a four-letter word response.

Medicare observation status can be sticker shock. It’s on the one hand mirage, on the other a kick in the gut.

Here’s how it works. You are sick, laying in a hospital bed. Doctors and nurses are checking on you regularly. You figure since you are in a hospital bed, you are “in the hospital” or inpatient care status. Your Medicare plan says that hospitals cover inpatient care on a co-pay basis. In your case, that is $350 per day for the first 4 days and then $0 thereafter. To your surprise, however, you find out you are under “observation care” (also known as Medicare observation status).

You remain in observation care. Observation care is outpatient care. Costs associated with outpatient care status with your plan are at a 20% coinsurance. Then, you receive your bill. You will have to pay a few thousands of dollars for your hospital stay instead of a few hundred!

In this article, we discuss how to prevent and mitigate the cost of Medicare observation status.

What Is Medicare Observation Status?

In short, observation care is used to minimize costs to the Medicare program.

Medicare observation status (or observation care) is for short-term hospitalizations.

The hospital believes you are not greatly ill for inpatient status, but you are not well enough to go home immediately, either.

You are expected to be in the hospital for 2 days or less. (In medical terms, that is less than 2 midnights).

Observation status gives the doctors time to evaluate your situation. They can then decide if you should be admitted as an inpatient or discharged.

An inpatient admission is generally appropriate for a 2 day (2 midnights) or more stay in the hospital.

Problems occur, however, when patients are in Medicare observation status and then they need skilled nursing care.

You see, Medicare will only cover a skilled nursing facility stay after a 3 day (3 midnight) inpatient stay in the hospital. Medicare does not cover skilled nursing care after an observation/outpatient care.

What does this mean? This means you pay 100% of the skilled nursing care if you are coded as observation!

Observation status is not the hospital’s or the doctor’s fault. They are under strict pressure from Medicare to correctly code you. They can face hefty fines if Medicare determines a wrong code (i.e. inpatient status coded instead of observation care).

Inpatient Versus Outpatient With Medicare Observation Status

To reiterate, Medicare Part A and B treat hospital services differently.

It is a big deal to your purse or wallet.

If you are covered as an inpatient in a hospital, you only pay the Part A deductible ($1,408 in 2020) and nothing after that (unless you are in the hospital for 60 days or more, whereupon you’ll pay a daily coinsurance amount).

If you are considered an outpatient in a hospital setting, you are responsible for 20% coinsurance with no maximum. (unless you have a Medicare Advantage or Supplement plan. More on that in a minute.)

Additionally, any drugs you receive while in the hospital fall under your Part D prescription drug plan. If the hospital is not in your drug network, you will have a hefty financial pill to swallow!

Finally, a big gap here is the skilled nursing care. If you are on observation care and admitted to a skilled nursing facility after your care, Medicare won’t pay. Plain and simple.

As you can tell, the potential costs of Medicare observation status after a hospital visit can be enormous.

Summary Of Medicare Observation Status

To make it easy for you, we created a Medicare observation status summary. Here it is below.

Medicare requires your physician and hospital to determine the correct billing status for your hospital stay based on your illness and the services that are provided to you. The quality of care is exactly the same regardless whether you are classified as an observation stay or inpatient admission. If your physician and the hospital have determined that your status for your hospital stay is observation care, this means:

- Your outpatient observation stay does not count toward the three-day inpatient stay requirement for admission to a skilled nursing facility.

- Medicare Part B pays for your observation care. Remember, observation care is outpatient care.

- Your expected length of stay in the hospital is less than 48 hours.

- Your physician will determine your actual length of stay based upon your condition and/or progress.

- You have an outpatient billing status, even though you may be in a regular hospital bed and receive some of the same services as a patient with an inpatient billing status.

Congress passed a new law that requires doctors and hospitals tell you what your status is. This communication prevents billing surprises. It does not help pay for your care if you are under Medicare observation status.

You might be thinking of how you will pay for observation care? We will talk about the costs of Medicare observation status next.

How To Mitigate Costs Of Medicare Observation Status

If you are under observation status (i.e. outpatient care), rather than inpatient, you will generally face higher out-of-pocket costs. Medicare and most Medicare Advantage plans cover outpatient care at 80% coinsurance, leaving you to pay up the remaining 20%.

Here is an example to make the point easy to understand:

You are in the hospital for 3 days and discharged. Your bill is $20,000. If you are classified as an inpatient, you would pay the Part A deductible of $1,408 (2020). Alternatively, if you had a Medicare Advantage plan, your Part A deductible might be lower. Each plan is different. However, if you are classified as an outpatient (part B services), you would have to pay $4,000 ($20,000 X 20%).

Moreover, if you needed skilled nursing care after your hospital stay, the costs of the skilled nursing care will not be covered if you were classified with Medicare observation status!

As you can see, the potential out-of-pocket costs can be financially painful.

This leads us to the following: mitigating observation status costs requires planning.

Most Medicare advocates suggest the following:

(1) stay informed. Ask every day about the status of yourself or loved one. Staying abreast of the situation helps.

(2) file appeal if necessary. Legal advocates suggest this is a long process. Advocates say to expect may denials in the beginning.

(3) enlist the assistance of an elder law attorney.

We at My Family Life Insurance respect these suggestions. However, we think that is a lot. We have some other suggestions which we discuss next.

Our Recommendations To Mitigate Medicare Observation Status Costs

We do agree that you need to stay informed, and the new law helps with that.

Filing appeals and hiring an elder law attorney seem long and expensive. If you want to go that route, then do so. We do recommend using an elder law attorney if you feel your Medicare situation is getting out of hand. If you feel over your head, then seek assistance from an attorney.

However, based on our experience, we feel you may not need to go that route.

Our recommendation is to plan at the beginning when you are planning your Medicare needs. In our opinion, planning is the easiest solution. If you want to fight afterward, that is up to you. You will then know the impact of observation care and can go forward accordingly.

Here in greater detail are our recommendations on how to mitigate Medicare observation status costs.

Recommendations To Mitigate Medicare Observation Status

(1) Purchase a Medicare Advantage Plan or a Medicare Supplement plan which waives the inpatient requirement for a skilled nursing facility. Medicare will not cover your skilled nursing costs if you had observation status. However, some Medicare Advantage plans will waive the inpatient requirement for skilled nursing facilities. Others won’t. That is why you need to know and plan from the beginning.

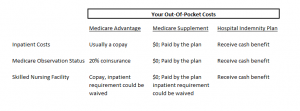

Since Medicare Supplement plans work in tandem with Medicare (Parts A & B), most plans (if not all) won’t pay for skilled nursing facility costs. However, they will pay 100% of hospital costs, regardless if you were inpatient or observation status (how much the plan covers depends on the plan you select). See the chart below.

(2) Purchase a hospital indemnity plan. These plans pay you a cash benefit upon a covered hospital event. For example, let’s say you are admitted to the hospital, an indemnity plan might pay you $500 for the admittance and then $750 for each hospital stay night.

The hospital indemnity plans we work with all pay benefits for observation status. This means you will have some coverage to pay for any observation status/observation care.

These plans are relatively inexpensive and give you peace of mind. See the chart below.

Now You Know How To Mitigate Medicare Observation Status

We hope you now have a better understanding of Medicare observation status and the impact it can have on your out-of-pocket costs as well as any potential skilled nursing home stay. In our opinion, planning and understanding this impact through your Medicare plan is the best solution. You can then hire an elder law attorney or go through the appeals process if you need to take your matter further.

Your next step? Contact us. Medicare is confusing. We can help select and tailor a Medicare plan congruent with your needs. We only work in your best interests; it is the only way we know how.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".