Let’s Clear Up Your Health Insurance Confusion | Understand And Save Money

Updated: April 12, 2024 at 9:40 am

I suspect that health insurance confusion is worse than filling out taxes. That’s what I feel when I speak to people about health insurance.

I suspect that health insurance confusion is worse than filling out taxes. That’s what I feel when I speak to people about health insurance.

People become even more confused when it’s time for the health insurance open enrollment period. This period runs from November 1st to December 15th every year.

We at My Family Life Insurance call it the “health insurance open confusion period”. Why?

Many individuals and families are simply and incredibly confused about their health insurance. For example, most people don’t know the difference between a copay and coinsurance. Not knowing these basics can have a negative impact…on your checking account!

In this article, we put a stop to the health insurance confusion, offering advice and tips so you can make informed, educated decisions that save you money.

This article will help your understanding of health insurance all year round, not just for open enrollment. We also provide a detailed example that clearly explains how health insurance works. Your days of confusion are over!

Here’s what we will discuss:

- Basics about open enrollment – a source of health insurance confusion

- Let’s put the health insurance confusion to rest

- Where most of the confusion comes from

- An example that brings it all together

- Now your health insurance confusion ends!

Let’s start with some basics about open enrollment. Open enrollment is another source of confusion for families. We address open enrollment next.

Open Enrollment – A Source Of Health Insurance Confusion For Families

As discussed, you can enroll in a new plan during the period of November 7 to  December 15th. If you do, your new plan will be effective January 1 of the ensuing year. This is the only time you can enroll unless you qualify for a special enrollment period.

December 15th. If you do, your new plan will be effective January 1 of the ensuing year. This is the only time you can enroll unless you qualify for a special enrollment period.

You may be eligible for a special enrollment period if you have experienced a qualifying change. This special enrollment period provides year-round enrollment. A qualifying change includes:

(1) loss of employer medical coverage

(2) termination of a plan you bought yourself

(3) moving

(4) married, divorced, had children

(5) death in the household

(6) if you are leaving incarceration. The law even allows ex-convicts a chance to enroll!

These enrollment periods are guaranteed issue. This means the carrier will not take into consideration your health history or any health conditions. You pick a carrier you think will work, apply, and you have new coverage effective January 1.

However, usually just picking one without doing your homework is a recipe for wasteful spending.

As for the health insurance enrollment period, many people are confused because they are simply confused about their health insurance plan. If they were not confused, they could make an educated assessment for the right plan for their family. More often than not, health insurance is your second or third largest family expense. Think about the money you can save!

Next, we begin the journey to end your health insurance confusion.

Confused About Health Insurance?

You are not the only one. Search on the internet of “how many people are confused about health insurance.” You will find pages of pages of websites all saying the same thing: many people need help. Many people don’t even know what a deductible, copay, coinsurance, and out-of-pocket maximum are.

Fortunately, understanding health insurance is easy once you understand what the components all mean. We will take you step by step to understand that.

First, we will begin by discussing the two most popular heath insurance types.

HMO or PPO?

The first thing you have to understand is the difference between an HMO and a PPO.

HMO stands for Health Maintenance Organization. These HMOs are insurance carriers, and they basically control where you need to go for your health care. HMOs have a network of doctors and hospitals. They have agreed to lower their rates provided you go to a doctor within the network. You generally can’t see anyone outside of the network unless for emergencies, for example.

Establishing a PCP (Primary Care Physician) is a typical requirement of HMO plans. A PCP is like a quarterback of your health care. Let’s say you need to follow up with a specialist. The PCP would establish a referral for you to see a specialist.

Conversely, a PPO, called a preferred provider organization, allows you to see anyone you want. Unlike an HMO, a PPO does not require you to establish a PCP. PPOs have a network of doctors, but the plan allows subscribers to see non-network providers if needed. If you see a network provider, you will pay less than if you saw a non-network provider.

In general, you pay a lower premium for an HMO plan than a PPO plan. Don’t let costs dictate which plan you pick. Your situation should dictate which plan you select.

So, in general, you will spend a lot less on a HMO health insurance plans compared to PPO insurance plans, all things being equal.

Is Your Doctor In The Network?

The second thing you need to know is if your doctor(s) is(are) in the provider network. A network is a list of doctors and hospitals that have agreed to reduced costs in return for using their services. Provider networks are an important piece of HMO plans. Your medical care won’t be covered if you go to doctors outside the network. Although PPO networks allow you to go to any doctor, going to doctors within the PPO network allow for lower costs.

The moral of the story: make sure your doctors and specialists are in your health insurance network. If that doesn’t matter to you, then feel free to pick a doctor from the network list.

Yet, I can’t stress enough that going to an in-network provider saves you money. You simply need to spend an hour, if that, researching the network list and/or confirming with providers the insurance they take.

Most Of The Health Insurance Confusion Comes From This

Most people have a general understanding of plan types (HMO and PPO) and provider networks. The health insurance confusion erupts when we start talking about costs: premiums, deductibles, copays, coinsurance, and out-of-pocket maximums.

The third thing you need to know is how these costs interact. To facilitate your learning, we provide a detailed example. First, though, we discuss these costs starting with Premiums,

Premiums: Pay No Matter What

The premium is the monthly cost to have the health insurance. You pay this no matter what. The premium allows you to have access to the lower network costs by going to doctors and services within the network. Or, for the flexibility of using a PPO plan.

Let’s say your monthly premium is $750 per month. You pay this no matter what, even if never use the health insurance all year or if you never go to the doctor.

It’s important to keep premiums as low as possible with the right balance of benefits for your needs and situation.

Deductible: You Pay This First

Deductibles are common with most insurances. Most likely, you have a deductible on your auto and home insurance. Dental, too. You probably have a deductible with your health insurance. You pay this first, no matter what, before insurance pays its share. Deductible levels range from $500 to $4,000 for families or more. We have even heard of health insurance deductibles beyond $10,000! Once you surpass this deductible level, the insurance kicks in.

Let’s see a deductible in action. Let’s say your deductible is $2,000. You have a doctor bill of $250. You would have to pay $250 outright since it is below the $2,000 deductible level.

If you had a $3,500 doctor’s bill, you would pay the $2,000 deductible first. The carrier applies the $1,500 balance to insurance and pays its share.

Copay: Your Prepayment Of Services

Your copay is the fixed amount you pay at the time of service. The cost is usually $15 to $25 for primary care services and $30 or more for specialist services. Hospital and ER copays could be $250 or more. Copays are usually charged at the time of service before the service takes place.

Deductibles and copays aren’t usually mutually exclusive. If you are still within the deductible period, you will still pay your copay, and the doctor will bill you the difference.

Using the previous example above, you go to the doctor and pay a copay of $20. You are still within the deductible level. The doctor’s invoice shows $120. Your doctor bills you $100 since you already paid $20 copay towards your share of the cost.

Coinsurance: Your Share Of Costs

Coinsurance is your share of the costs. It takes place once you have paid your deductible in full. Coinsurance is a percentage share of costs.

The most standard coinsurance is 20%. This means you pay 20% of allowed charges.

For example. If you have a doctor’s bill of $100, the plan will pay $80, and you would pay $20.

Out-Of-Pocket Maximum

Out-of-pocket maximum (OOP max) is the maximum costs you will pay annually for your out-of-pocket costs. This excludes your premium but includes your deductible. Out-of-pocket maximums are separately assigned to individuals and families. It is common for an individual OOP max to be $5,000 or more and families $10,000 or more! These amounts reset back every year. Once you surpass this amount, the insurance will pay 100% for covered services.

A Health Insurance Example To Bring It All Together

Here is an example that will bring it all together.

You have an HMO plan that costs $750 per month. Your deductible is $2,000, coinsurance 20%, and copay $20. The OOP max is $5,000.

In January you see the doctor. You pay a copay of $20. The allowed charges are $225. Since you are within the deductible, you must pay this amount in full. The doctor bills you $205 since you already paid the copay. The $225 goes towards your OOP max. You still have to pay the $750 per month premium. This does not go towards your OOP.

In February, you have a knee replacement. You spend $250 on the hospital copay. Ultimately, the allowed hospital charges are $10,000. You pay the $1,775 towards the deductible which includes your copay. The remaining $8,225 is subject to insurance. Of this amount, you pay 20%, or $1,645.

As a summary, in February, you paid $3,420 ($1,775 and $1,645). So far this year, you have spent $3,645 toward your OOP max. You still have to pay your premium of $750.

Now you can see how quickly your costs can rise.

Costs Keep Accumulating: Example Continued

In March, you slip on ice and hurt your back. You pay a $500 copay for the ambulance ride and a $250 copay for hospital admission. It turns out that you have herniated disc. The bill is $7,500. Since the deductible has been paid, insurance applies to the full $7,500. Your share of costs is $1,500 ($7,500 X 20%). Since you already paid $750 ($500 ambulance and $250 hospital), so you owe another $750.

You still have to pay your premium of $750.

As a summary, in March your out-of-pocket costs are $1,500. This brings your total costs to $5,145. Since this is higher than the $5,000 OOP max, your bill is $605 ($750 – $145). You no longer have out-of-pocket costs, but you still have to pay your $750 monthly premium.

In April, you are at a stop light. You think how much bad luck and hospital bills you have had this year. Then, you are rear-ended! You are taken to the hospital and examined for head and neck injuries. Provided these services are in network, you will have $0 costs. You still have to pay the $750 premium.

You will always have to pay the $750 premium.

Premiums Are Inversely Proportional To Out-Of-Pocket Costs

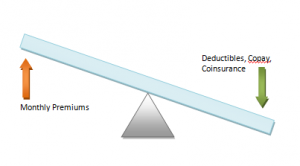

Now that you know how all the costs interact, you need to balance your premium budget with out-of-pocket costs. It is like a see-saw:

If you want lower deductibles, copay, and coinsurance, expect to pay a higher monthly premium and vice-versa.

Now Your Health Insurance Confusion Ends!

We hope that after reading this article, you are no longer confused about health insurance.

How do you apply to what you have just learned? Easy. Review how much you will use your insurance and how much protection you want against out-of-pocket costs. Then look at the plan’s deductible, coinsurance, copays, and OOP max. Find what works best for you. Generally speaking, the lower the deductible, copay, coinsurance, and OOP max, the higher the premium. Remember, this is all like a see-saw

If you don’t know where to start, My Family Life Insurance can help. We have helped many individuals and families review their health insurance spend and determine the right plan for their needs. Contact us or use the form below and experience an agency that works in your best interest at all times.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".