3 Solid Reasons Why Accident Insurance Is Worth It

Updated: April 12, 2024 at 9:38 am

Some say yes, others say no. We at My Family Life Insurance say that accident insurance is worth the money; however, as we always have said, the decision depends on your unique situation.

Is accident insurance worth the money for you? Read on to find out more. In today’s health care and insurance environment, chances are, it is.

- What Is An Accident Insurance Policy?

- What Do Accident Insurance Plans Cover?

- Do Accident Insurance Plans Underwrite?

- 3 Reasons Why Accident Insurance Plans Are Worth It (i.e. Money)

- Who Can Benefit From Accident Insurance

- FAQs About Accident Insurance

- Final Thoughts

Let’s start off and answer the question, “What is an accident insurance policy?”

What Is An Accident Insurance Policy?

An accident insurance policy pays you tax-free cash benefits upon injury or death from an accident.

An “accident”, in insurance terminology, means a sudden, unexpected, and unforeseen event that causes injury or death (many carriers have nuances of this definition. It is always best to find out how insurance companies define an “accident”.)

Accident plans are a type of supplemental insurance that works in concert with major medical insurance or high-deductible health plans. They are typically a standalone policy separate from your health insurance. Accident insurance plans relieve the financial burden of high deductibles, copays, coinsurance, and other out-of-pocket expenses.

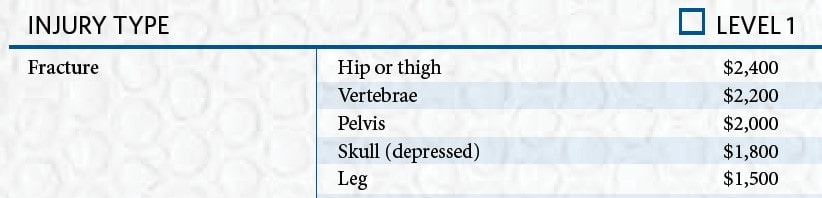

Plans typically pay via fixed benefit indemnity, which means a lump sum per a set payment schedule. Here is one example of a payment schedule from an accident insurance policy. You can see that, for example, this particular plan pays $1,500 for a broken leg.

(However, some plans coordinate with your primary health insurance coverage. More on that in a minute.)

These plans will cover injuries and deaths from:

- On-the-job and off-the-job accidents

- A fatal accident like a car accident

- Playing sports (some policies will not)

- Recreational injuries

- Just about any situation that involves an accident (there are exclusions, like the typical Acts of War, being incarcerated, etc.)

Who Is Covered?

An accident insurance policy will cover:

- Yourself

- Your spouse

- Your children

- Other family members

That means if your kids play sports and get hurt (provided that is covered), the accident plan covers the injury and associated costs. If your spouse dislocates his shoulder while doing yard work, the plan pays a benefit. If you slip on the bathroom floor while getting out of the shower and injure yourself, the plan pays the corresponding benefit amount related to your injury.

I think you see what I mean.

Accident insurance will generally cover nearly all injuries and costs associated with an accident (as mentioned, there are exclusions). Some policies will even cover accidental death and dismemberment. In other words, many plans contain a life insurance component that pays a benefit amount if you die from accidental injuries.

Recently, other carriers have issued other types of accident insurance. As we mentioned, these types pay up to your health insurance’s out-of-pocket costs for any accident. In other words, they coordinate with your health insurance.

Some Exclusions

Some Exclusions

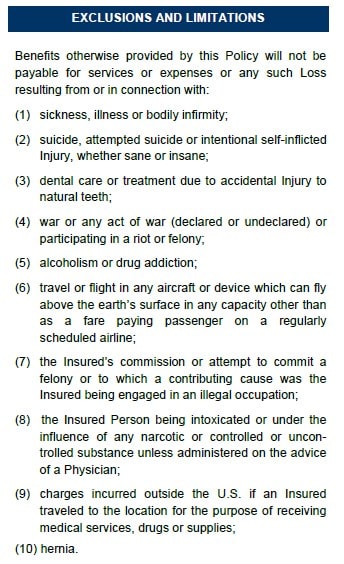

To recap, this insurance pays cash benefits to you upon an accidental injury or accidental death. It does not pay on gradual “wear and tear” or other degenerative conditions.

If you are hurt committing a crime, that’s not covered. (Obviously.)

It’s important to review the limitations and exclusions of your policy. Here is one example.

Nearly all insurance carriers have similar exclusions and limitations, although there are nuances.

Accident insurance also, generally, does not cover an accidental sickness. See our article on the best accident insurance policies which outlines some policies that cover accidental sickness (such as that from an accidental ingestion of poison, for instance.)

What Does Accident Insurance Cover?

Accident insurance plans cover wide-ranging situations including, but not limited to:

- hospital stays – resulting from an accident

- emergency room visit

- burns (like third-degree burns)

- broken bones

- stitches

- urgent care visits

- surgeries and medical treatments

- ICU situations

- ambulance rides (even Lifelight helicopter)

- death or dismemberment from an accidental injury

- follow-up doctor visits from an accidental injury like physical therapy, orthopedic visits, etc.

- and much more

Remember that these plans pay a cash benefit to you that you use for your medical costs. Your primary health insurance plan will cover some of the costs, but unlikely all of the costs. This is where an accident insurance plan proves beneficial. You can use that benefit payment for your out-of-pocket medical costs (deductibles, coinsurance, etc.) or even non-medical expenses. No restrictions exist on how you use your cash benefit.

Let’s go over how much you receive next.

How Much Do I Receive?

It depends. The amount of benefit you receive depends on the injury and associated costs.

For example, you go to the ER for an injury. An accident policy might pay $300 for the ambulance, $500 for the ER visit, $1,200 for the surgery, $1,500 for the hospital admittance, and $50 for a physician follow-up.

In this example, the carrier sends you a cash payment of $3,550 that you can use for your medical expenses or non-medical expenses.

It doesn’t matter what other insurances you have; the plan pays upon covered accidents and the corresponding treatments. The money goes directly to you. With deductibles, copays, coinsurance, and premiums seemingly increasing higher and higher, these accident policies can offset the cost and leave you a cushion.

Or, as we said, you can use the money however you want. Cash benefits are also income tax-free.

Good plans also cover accidental death and dismemberment. In other words, there is a life insurance component if you die from an accidental injury. Most plans will pay up to $100,000 for common carrier accidental death, $75,000 for car vehicle accidental death, etc.

As we mentioned, some plans pay up to the out-of-pocket maximum of your health insurance. For example, let’s say you broke your leg ice skating. Your bill is $2,430 dollars because you are in your insurance’s deductible phase. Your plan pays the $2,430.

With these “lump sum” plans, you have to select a “bucket of money” for the year. When the money runs out for the year, it runs out. The “bucket” replenishes every year.

Families with children will want accident plans that cover recreational and organized sports. Make sure your plan covers this.

Do Accident Insurance Plans Underwrite?

Underwriting is the process of analyzing a risk and the probability of a financial loss occurring with that risk. Then, determining whether to accept or decline that risk. In this case, the risk is the probability of being injured or dying from an accident.

While other types of insurance, like life insurance, underwrite based on health, driving record, etc, accident insurance traditionally does not underwrite. Insurance companies offering accident insurance aren’t going to ask you about your health, etc.

Carriers may ask a couple of formality questions like insurance replacement (beyond the scope of this article), but that is about it.

Carriers may ask a couple of formality questions like insurance replacement (beyond the scope of this article), but that is about it.

However, a few carriers do have occupation restrictions. They will decline your occupation if you have a high-risk job like fishing, mining, etc. Here is an example.

Note that many carriers don’t have occupation restrictions. For example, we have placed many police officers and first responders in accident plans. Contact us if you have any questions.

Let’s discuss the 3 reasons why accident insurance is worth the money.

3 Reasons Why Accident Insurance Is Worth The Money

I hope you’ve learned a lot about accident insurance so far. We discuss 3 reasons why accident insurance is worth the money.

Accidents Happen A Lot…And, They Are Expensive!

According to the CDC, about 131 million people visited the ER in 2020 (some adjustments were made for the COVID pandemic). Of these, 131 million, about 38 million were injury-related emergencies.

According to the CDC, about 131 million people visited the ER in 2020 (some adjustments were made for the COVID pandemic). Of these, 131 million, about 38 million were injury-related emergencies.

Additionally, according to United Healthcare, the average ER visit costs the average person $2,600. Wow!

Accidents and injuries do happen and happen often.

Ask yourself (and look at your health insurance plan), do you have the financial means to pay your deductible, copay, coinsurance, and other out-of-pocket expenses in the event of an accident or injury?

Probably not…

Health Insurance Isn’t Getting Cheaper…

Have you looked at your health insurance premiums lately?

Yes, John. Sometimes I feel like I am paying a second mortgage…

I know, right? Well. Not only are premiums going up, but also are deductibles, copays, and coinsurance.

In other words, the additional cost of your share (that is what these deductibles et al. are) is going up, too.

Most people don’t have $10,000 saved for an emergency visit or treatment.

Yet, how will you pay your medical costs if you do have a moderate or severe injury?

That is where an accident insurance plan helps. It will pay a benefit that you can use for those deductibles, coinsurances, etc.

John, you make a great case, but I don’t want to be insurance poor.

I hear you, but you need to include these supplemental plans like accident insurance as part of your overall health insurance strategy.

Moreover, you won’t go broke with accident insurance.

Accident Insurance Costs About $1 Per Day

Thankfully, accident policies are usually affordable. Why are they affordable? Well, the probability of getting hurt from an accident is low.

However…

When it does happen (and let’s be honest, we have all had an accidental injury), the ensuing medical bills can be costly. A trip to the ER alone costs your insurance thousands. Additionally, if you are in the deductible stage of your health insurance, you are paying the entire medical bill.

the ensuing medical bills can be costly. A trip to the ER alone costs your insurance thousands. Additionally, if you are in the deductible stage of your health insurance, you are paying the entire medical bill.

So, what does accident insurance cost? For an individual, most accident insurance premiums cost between $20 and $30 per month, depending on the plan.

That is right. $30. $1 per day.

You can spend $1 per day, right?

For a family, of course, it will be a little more. Maybe $50 per month or more, depending on the type of coverage you want. (Many carriers offer different levels of coverage.)

Want to see the best personal accident insurance policies we like? Go ahead. We break it all down for you and did the dirt work so you would not have to.

Who Can Benefit From These Policies?

These policies can nearly help everyone. In fact, according to the National Safety Council (link), nearly 39 million Americans receive medical attention for non-fatal injuries each year. You might benefit from these policies if you:

- have an active family, active lifestyle, playing sports, etc.

- have a hazardous, high-risk job (some jobs are excluded, but most policies cover seemingly hazardous jobs like fishing, tree cutting, etc.)

- enjoy hazardous hobbies like motorcycle riding, deep water scuba diving (hang gliding and rock climbing are typically excluded from policies)

- want an accidental death and dismemberment benefit on your life insurance policy – we have found that, in most cases, the stand-alone accident insurance plan cost less and offered more benefits than an accidental death and dismemberment rider on the life insurance policy

- You drive long distances for work: tractor-trailer driver, a consultant, etc.

- You want to offset the high out-of-pocket costs associated with your underlying health insurance plan

The last bullet point is the most common. Many individuals and families are facing higher premiums and out-of-pocket expenses with their underlying health insurance. One way to offset that is to increase the deductible and therefore lower the premium. The accident insurance can then be purchased to fill the gap and pay for any deductible or out-of-pocket costs. In this case, we feel accident insurance is worth the money.

Who Should Not Purchase Accident Insurance?

Accidents can occur anywhere and anytime. That’s why we believe everyone should have some level of accident coverage; however, if you have enough money saved to cover your deductibles and maximum out-of-pocket costs on your primary health insurance plan, then you probably don’t need accident insurance (even though it is cheap).

Additionally, if you don’t have any of the following policies, then you don’t need accident insurance right now. You need these policies first:

-

- life insurance policy

- disability insurance policy

- health insurance policy

If you do not have the above, you need to purchase those first before thinking about an accident insurance policy.

These policies tend to have limits on ages. If you are age 70 or older, chances are an accident policy isn’t available. In that case, we recommend a hospital indemnity plan, which operates similarly to an accident plan. These plans cover hospital services and are useful in tandem with Medicare plans.

Frequently Asked Questions About Accident Insurance

We answer some common questions about accident insurance.

Is there a waiting period on the accident insurance?

Most carriers don’t have a waiting period on the start of your policy. In other words, you apply and select the start date of your policy. That date is the effective date, and as long as you paid the first premium, you are covered. Conceivably, if you injured yourself the next day, the plan will pay.

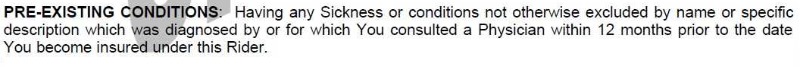

What about a pre-existing condition? Is that covered?

Usually, no. As we discussed, accident insurance will cover an injury that is sudden and unexpected. Accident insurance also does not cover illnesses or any other chronic injuries.

Moreover, many policies have language contained like this to protect the carrier against any pre-existing conditions:

If a carrier covered a person with a pre-existing condition, then that could spell trouble for other policyholders. The carrier would have to pay out above-average claims for this person. In order to compensate for these above-average claims, the carrier would have to increase the premiums for other policyholders. This concept is called adverse selection and why the pre-existing condition clause exists.

If a carrier covered a person with a pre-existing condition, then that could spell trouble for other policyholders. The carrier would have to pay out above-average claims for this person. In order to compensate for these above-average claims, the carrier would have to increase the premiums for other policyholders. This concept is called adverse selection and why the pre-existing condition clause exists.

Do I need to take a medical exam to qualify?

No, insurance companies that offer accident insurance do not require a medical exam, only the application.

Does Accident Insurance cover prescription drugs?

Not usually, but if it does, the coverage is from a covered injury or accident.

Some hospital indemnity policies (link) do cover prescription drugs.

Will Accident Insurance pay out on a permanent disability?

Possibly. If so the accident insurance policy pays out because the disability is from an unexpected accident or injury. However, remember, this pay out is a lump sum cash benefit only to cover medical care costs like deductibles, coinsurance, etc.

If you need a monthly benefit paid to you (to support everyday expenses like groceries, mortgage, etc), then accident insurance isn’t the way to go. You need disability insurance.

Contact us to learn more.

Now You Know That Accident Insurance Is Worth The Money

We at My Family Life Insurance believe the low monthly premiums combined with the extensive coverage benefits make accident insurance worth the money.

Accident insurance policies pay a benefit upon covered accidental injuries. Moreover, they can act as accidental life insurance. In other words, if you die from an accidental injury, the policy pays a death benefit similar to that of life insurance.

We hope this article gave you a better understanding of accident plans. Do you think you and your family need one? We at My Family Life Insurance can help you determine that. We always place your best interests first. If we feel you don’t need one, then we will tell you that. Feel free to call, text, or email us. Or, use the form below. We will be happy to speak with you.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".