A Massachusetts Small Business Health Insurance Plan Worth Looking Into | You Can Potentially Save Money With This Plan

Updated: April 12, 2024 at 9:38 am

I think you will agree with me that small business health insurance here in Massachusetts (MA) can be expensive.

Massachusetts (MA) can be expensive.

You want to do right for you and your employees. Heck, health insurance here in the US is extremely important. However, some of these premium quotes you receive are no short of “sticker shock”.

Moreover, you pay your bill, and you wonder where the money goes.

It doesn’t have to be this way.

You can have great health insurance coverage for you and your employees and not pay an arm and a leg for it.

We’ve helped many small businesses establish affordable health insurance coverage in Massachusetts, and I am sure we can help you, too!

In this article, we discuss the following:

- Heath Insurance In Massachusetts

- What A Small Business Does For Health Insurance Here In Massachusetts Now

- How A Self-Funded Health Insurance Plan Works

- Attributes Of A Self-Funded Health Insurance Plan

- Example Of A Self-Funded Health Insurance Plan

- Difference Between A Self-Funded And Fully-Insured Plan

- Types of Firms That A Self-Funded Plan Works Well

- FAQs About Small Business Health Insurance In Massachusetts And Self-Funded Plans

- Now You Know A Small Business Here In Massachusetts Can Get Affordable Health Insurance

Let’s start off a describe the current landscape for health insurance in Massachusetts.

Health Insurance In Massachusetts

Unlike other residents in most other states, Massachusetts residents are subject to an individual mandate. Like the federal health mandate (that was subsequently eliminated on 1/1/19), the individual mandate in Massachusetts requires residents to obtain qualifying health insurance coverage.

You may not be aware that the states primarily govern health insurance as well as the health insurance coverage options available. This is why, for example, residents in Texas can obtain a short-term medical plan, but Massachusetts residents can not (because short-term health insurance plans do not follow MCC requirements).

Health plans in Massachusetts are different compared to plans in other states. Health coverage in Massachusetts must follow set rules as set forth by the state’s individual mandate. Allowable health insurance options in Massachusetts must follow minimum creditable coverage (MCC) requirements.

For example, for a health insurance plan to qualify under the MCC, it must not cover only a fixed dollar amount per day or stay in the hospital, with the patient responsible for all other charges. In other words, the popular fixed indemnity health plans offered elsewhere around the country are not allowed in Massachusetts.

Massachusetts residents obtain qualified health insurance either through their employer or through the state’s health insurance marketplace called the Health Connector among other options.

Current Health Insurance Options For A Small Business Owner In Massachusetts

Most small business owners want to help their employees. A great way to do that is by offering health insurance to their employees. Thousands of businesses offer health coverage to their employees and subsidize some, or all, of the monthly premiums.

However, here in Massachusetts, health insurance options for small business owners are, let’s say, limited.

Now, what do I mean by that?

Well, I don’t mean there are limited choices. No, there are plenty. Many great health insurance carriers, such as Harvard Pilgrim Health Care, Blue Cross Blue Shield of Massachusetts, and Tufts Health Plan, offer plans to small business owners in Massachusetts.

The problem, we have heard, is that these plans cost a lot of money.

Most Small Business Owners Go Through The Massachusetts Health Connector For Health Insurance In Massachusetts

Most small business owners in Massachusetts will go on the Massachusetts health connector and search for plans. The health connector is the state’s health insurance marketplace.

What draws the small employers is that they have the potential to receive 50% premium tax credits on their costs.

However, this credit comes with some limitations:

- Must have fewer than 25 full-time employees (25 full-time equivalent employees, to be specific.)

- Average employee salary is $56,000 or less

- Must pay a minimum 50% share towards the health insurance premiums

- Health insurance must be purchased through the health connector marketplace

For most small business owners, the full-time employee requirement is no big deal. Many businesses in Massachusetts have fewer than 25 employees.

deal. Many businesses in Massachusetts have fewer than 25 employees.

The problems lie in the next requirements. The average employee’s salary has to be $56,000 or less. A restaurant might be able to meet this requirement, but a medical practice or engineering firm is likely not.

Additionally, you need to pay a minimum of 50% toward your employee’s health insurance premiums. A medical group should be able to meet that just fine. However, we just said they probably could not meet the $56,000 average salary requirement.

Conversely, that restaurant might have a hard time meeting that minimum 50% even though it could probably meet the average salary maximum.

You May Not Qualify For The Credit

There are great plans available through the health connector. However, your business may not qualify for the 50% credit.

Do you see that?

What do you do?

Well, you think you don’t have many options. You enroll in a plan. Maybe you can only contribute 30% of the health care premiums. You, your family, and your employees need qualified health insurance, so you purchase a plan.

You pay a lot, and you don’t feel like you are receiving any benefit. Moreover, you don’t even know where the money is going. You are spending a mint every month.

You don’t think there is a better way.

Possibly A Better Health Insurance Option For A Small Business In Massachusetts

There could be.

There could be a group health insurance plan where you can receive a portion of your money back.

Additionally, there are no restrictions like paying a minimum percentage of health insurance premiums.

Moreover, no average salary requirements.

You’ll also have more control over seeing where your premium money goes.

What is it?

It is called self-funded health insurance.

Geez, John, you say. I pay health insurance so I won’t have to fund it myself!

Well, you do…and you don’t…

Moreover, I can almost guarantee that the price will probably be less than what you pay through the health connector.

Before you think this won’t work for you, let’s discuss what self-funded plans are.

How A Self-Funded Health Insurance Plan Works For Small Business Owners In Massachusetts

Contrary to what you may think, self-funded health insurance plans are a convenient way to offer affordable health insurance to employees. (And, even to 1099 contractors, too.)

Yes, it is true. In a self-funded arrangement, the employer assumes responsibility for the costs and benefits.

However, that is really not as scary as it sounds.

The plans provide a stop-loss dollar level for employers. The employer is not responsible for any claims above this dollar level. Additionally, if claims are less than anticipated, employers can receive some money back. We will go over these two attributes soon.

First, some notable information about self-funded health insurance:

- Governed by law

- Must meet minimum essential coverage, so no tax penalty for employees

- Covers small businesses with between 2 and 50 employees

- Employees working 20 or more hours per week are considered full-time

- 1099 contractors accepted

- No additional risk for employers

- Customizable health insurance designs

OK, John, you say. I’ll take your word so far. But, how much will this cost me?

Let’s introduce that next.

What Are The Employer’s Costs?

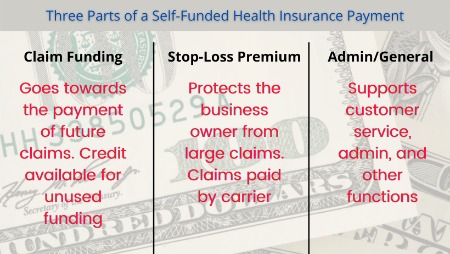

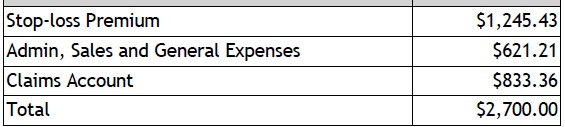

With self-funded health insurance plans, employers pay one payment each month. Each payment consists of:

- Stop-loss premium

- Claim funding

- Administrative costs

The claim funding is the dollar amount paid towards projected claims and health care costs. When employees have a medical event, the insurance company pays the claim from this fund.

The stop-loss premium is insurance itself. If claims exceed the claim funding maximum level, called the aggregate limit, then the insurance company pays 100% of the claims.

The administrative costs are self-explanatory.

Here is an example:

Please note: in Massachusetts, employers may be responsible for any pediatric vaccines.

It’s important to reiterate that the employer’s maximum is the claims funding. If claims exceed this amount, the stop-loss kicks in. The carrier then pays 100% of the claims after this.

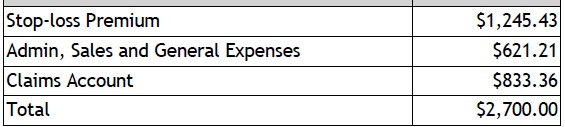

In this example, you, as the small business owner, pay $2,700 per month for the plan.

The claims funding amount, in this example, is $10,000 ($833.36 X 12). For any claims over this amount, the insurance company pays.

We provide a detailed example later in the article.

How Does The Rebate Work?

We mentioned earlier that employers can receive a rebate for fewer monetary claims in a year.

This rebate is 50% of the savings.

Here’s how it works.

Let’s say your aggregate limit is $30,000. Your company has total claims of $15,000. You then receive 50% of this difference ($30,000 – $15,000) or $7,500.

Sounds good, John. What happens to the other 50%?

The carrier keeps it to offset their administrative costs.

You mean, I don’t keep it?

Not the other half. It is used to keep your monthly premiums low.

Sure, you may want the other half, but I think you’ll agree about low premiums, right?

Attributes And Options of A Self-Funded Health Insurance Plan

Self-funded health insurance plans have important attributes, even those for small business owners in Massachusetts

We discussed the 3 attributes above:

- The claim funding bucket (i.e. aggregate limit)

- The stop-loss premium

- Administrative costs

However, plans must also meet the following guidelines.

- Specific state guidelines, if any (any individual mandate or employer mandate, for example)

- ERISA

Additionally, self-funded plans provide to following:

- Customizable plan designs

- Provider Network Access

- HSA and HRA integration

- COBRA administration

- Customer service and administration for employees and business owners

The carrier offers thousands of health care combinations that will meet your needs.

Example Of A Self-Funded Health Insurance Plan In Massachusetts

OK, John. This all sounds good. Can you give me some numbers, costs, or an example?

Sure. Let’s walk through an example. Look at this below. This is a quote for a 5-person small business in Boston.

You can see below, this is what the business owner pays each month. We presented this previously.

Do you mean, I pay $2,700 per month?

Yes. $833 per month goes to the claim funding amount. If you multiply this number by 12, you get $10,000. This $10,000 amount is your claims “bucket”. As your employees go to the doctor and receive services, the carrier pays claims from this “bucket”.

The $1,245 is the stop-loss premium. This is the “insurance for your insurance” so to speak. If your claims exceed $10,000 as noted above, in this example, then the carrier pays 100% of the claims. In other words, payments to providers and other services come from the carrier at this point, not from you.

The $621 admin expenses are self-explanatory. This is how the carrier makes money, but also is your customer service support and other important services.

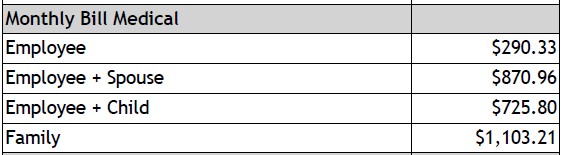

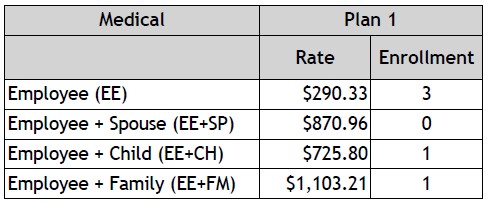

OK, so what do the employees pay?

Good question. See this census below:

This is what the employees will pay. How does this correspond to your monthly bill? Well, see below:

If you do the math, the total is $2,700.

Now, many employers share in the cost of health insurance, right? So, if you want to pay 50%, you will receive $1,350 each month back. How?

So, you’ll pay the carrier $2,700. Conversely, you will deduct $1,350 in total from your employees through payroll. They pay $1,350 and you, in effect, pay $1,350 per month.

How Does The Credit/Rebate Work?

Many people ask us about the credit, and how does it work?

We discussed this earlier, but it bears repeating.

Remember, Massachusetts does offer small businesses a premium tax credit through the health connector, but stringent requirements exist.

It’s best to use the example above. Remember, the $10,000 maximum aggregate limit?

Yes, John, that is the claims funding account. The $833 X 12 months.

Right. So, if your claims are less than that, you get 50% of the difference. So, let’s say claims are actually $5,000.

You will receive a check for $2,500. ($10,000 – $5,000) = $5,000 X .5 = $2,500.

OK, that sounds good. What happens to the other 50%?

Well, the carrier keeps that. Before you say, #%^*!, it’s important they do. That money offsets their own costs to keep your premiums low.

John, it would be nice to have that other 50%.

I hear you. However, consider the alternative. Do you know where your money is going? I doubt it. Here, the carrier is transparent. They have to be.

But, they offset that 50% off their internal costs to keep their costs low. Sure, it would be nice if they could put that extra 50% in a future claims “bucket” in case you did exceed your annual claim amount.

Maybe they will consider that option in the future. For now, though, the remaining amount offsets their internal costs. Personally, it is all good.

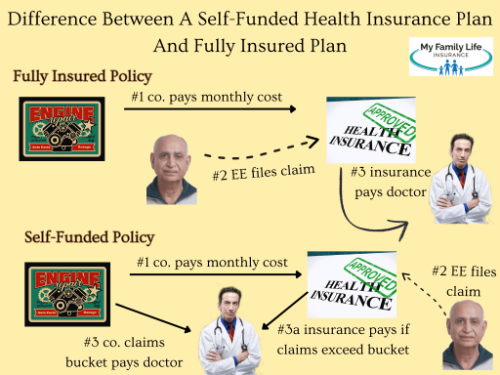

Difference Between A Self-Funded And Fully-Insured Health Insurance Plan

This all sounds good, John. I am not totally sold on it, though. Do you mean to tell me that the self-funded option works the same way as the traditional health insurance I have?

This all sounds good, John. I am not totally sold on it, though. Do you mean to tell me that the self-funded option works the same way as the traditional health insurance I have?

Yes and no.

If you purchase a traditional health insurance plan (technically called fully insured or level funded), your premium money pays for the insurance company to cover claims.

Conversely, with self-funded health insurance, you pay these health insurance claims yourself through your monthly premium. As we discussed earlier, a stop-loss limit exists. If claims exceed this stop-loss dollar limit, then the carrier pays claims 100%.

Because you are undertaking part of the claim risk, your premiums are generally less than that of a fully-insured plan.

Additionally, as a business owner, you could go years without seeing a significant claim experience. This depends on the age, gender, and health of your employees. Let’s say your workforce is made up of younger, healthier employees. Then, you may only be paying claims for health checkups and the occasional childbirth.

Now, from what your employee sees, there is no difference between a self-funded health insurance plan and a traditional health insurance plan.

The self-funded insurance carrier still pays for medical expenses and medical care like checkups, hospital stays, childbirth, labs/x-rays, ER visits, virtual care (like Teladoc), prescription medication, etc.

Employees still have deductibles, coinsurance, and copays on their plans. So, these cost-sharing attributes delay payment from your claims bucket as well.

Types Of Small Business Firms That Work Well For Self-Funded Health Insurance Plans Here In Massachusetts

Any small business here in Massachusetts works well with self-funded health insurance plans. However, those businesses in the 2 to 30-employee range seem to have better pricing.

As we stated, though, some businesses won’t be eligible for the health connector premium credits because of either:

- Average salary above $56,000, or

- Paying a minimum of 50% of the premium or more

So, here are some of the many types of businesses that work well for self-funded health insurance plans in Massachusetts:

- Engineering firms

- Law firms

- Medical offices and businesses

- Technology firms

- Really, any company that can’t meet the available credits through the health connector

Additionally, carve-outs are allowed. What’s a “carve-out”? All this means is you split a certain group of employees from others.

Most carve-outs are with executive management or all managers, for example.

So, let’s say you want only to offer a self-funded health insurance plan to managers, you can do that.

Additionally, husband/wife and family businesses are allowed. However, there are important requirements in these cases. It is best to contact us if you have questions.

Frequently Asked Questions About Small Business Health Insurance In Massachusetts

Here are some frequently asked questions about small business health insurance in Massachusetts along with answers to self-funded health insurance.

I am a “solopreneur”. Can I enroll in self-funded health insurance?

No, unfortunately, the carrier doesn’t allow a sole proprietor to enroll in a plan. You need at least 2 employees.

Does the self-funded health insurance include dental insurance?

It depends on any state and employer mandate. Usually, no, but we can include dental insurance within the benefits package.

Does self-funded health insurance follow the guidelines set forth in the Affordable Care Act?

The federal government established the Affordable Care Act in 2010. The self-funded health insurance follows the minimum essential coverage (MEC), established by the Affordable Care Act, where required. For Massachusetts, qualified plans follow the minimum creditable coverage set forth by the state’s health insurance mandate.

Every year, as a participant in the self-funded health insurance, you will receive the required MA-1099 HC which indicates how many months you were enrolled in a qualified plan that met Massachusetts’ MCC.

Are health conditions excluded from the self-funded health insurance plan?

No. These plans will cover all types of health conditions including pre-existing conditions.

How many plan options are there with self-funded health insurance?

The carrier offers many health insurance companies and plan combinations. They offer many benefit solutions and can coordinate with HSAs, HRAs, etc. The carrier offers different types of health plans to meet your company’s needs and budget.

What about seasonal workers and part-time workers?

Seasonal workers are not eligible for health insurance. Part-time workers could be, depending on the make-up of your workforce. Contact us for more information.

Can’t I just buy a SHOP plan off the state’s website?

You can, but you may be paying much more than you need to. Note: a “SHOP” plan is simply a plan purchased through the state’s small business exchange. SHOP means Small Business Health Options Program (SHOP). For Massachusetts, business owners interested in a fully insured health insurance plan purchase these plans through the health connector.

How does the claims processing work with the self-funded option?

You as the small business owner pay claims out of a “claims bucket” which you fund with part of your monthly premium (see our example above). A stop-loss limit exists so if claims exceed this stop-loss amount in a particular year, you don’t pay anything additional (other than your required monthly premium).

If claims are less than what is expected, you receive part of the savings back.

Contrast this with a fully insured health insurance plan where you pay a premium for a 3rd party insurance company to pay ALL claims.

This method typically yields a higher required monthly premium compared to the self-funded option.

Are supplemental insurance plans available?

Yes, supplemental insurance plans like:

- dental insurance

- disability insurance

- life insurance

- critical illness

- hospital indemnity

…are available for group coverage. Contact us to learn your options.

How do I get started?

If you want to see what a self-funded health insurance option compares to a fully insured plan, please contact us. We will require an employee census that includes gender, age, and tobacco status. We send it to you, you fill it out, then we provide you with a quote within a few days.

Note: we have many small businesses that opt for the self-funded plan and some that decide not to. Do you want to see how a self-funded plan stacks against other options? You may be doing a disservice to your company by not doing so.

Now You Know How Small Businesses Here In Massachusetts Can Get Affordable Health Insurance

Are you a small business owner here in Massachusetts needing affordable health insurance options for your company? A self-funded insurance plan can work. We showed the steps and what is involved.

As we discussed, you have a “stop-loss” limit. That means your claims are capped. Moreover, these plans potentially save you money versus a fully-insured plan (like those through the health connector).

Would you like to learn more or want a quote? Feel free to contact us or use the form below. It’s easy; we just need a census of covered employees and/or 1099 contractors.

As I always say, there is no risk with contacting us. If we can’t help you, you’ve learned a little more. We will part as friends. Seriously! I know most agents or agencies can’t say that. However, we can because we always put your interests first, not our own.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".