Here Is Why Life Insurance With Living Benefits Is Worth The Money | This Type Of Life Insurance Provides More Flexibility

Updated: April 12, 2024 at 9:39 am

Do you think life insurance with living benefits is worth the extra money?

Do you think life insurance with living benefits is worth the extra money?

John, I have no idea what you are talking about, you say.

Wait. Have you heard about life insurance with living benefits?

If you don’t know what living benefits are, don’t worry. I will explain what they are in more detail.

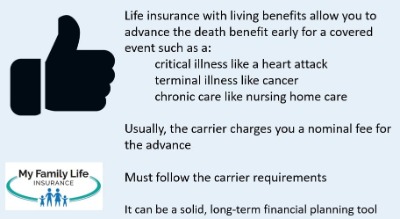

Here is the abridged version, however: Living benefits are a useful way to advance part of your death benefit early, while alive (or “living”) if certain, covered events happen.

That means you get your money now rather than your beneficiaries at death.

As you can guess, life insurance with living benefits is different than traditional life insurance. It does cost more, and we will get into that. Many people wonder if life insurance with living benefits is worth the money.

We discuss that and a lot more, so you can make an educated decision.

In general, however, yes life insurance with living benefits is worth the extra cost.

Here is what we will discuss:

- What Is Life Insurance With Living Benefits?

- Why Is Living Benefits Worth The Extra Cost

- Cost Of Living Benefits

- Types Of Life Insurance With Living Benefits

- Final Thoughts About Life Insurance And Living Benefits

Let’s discuss what living benefits are next.

What Is Life Insurance With Living Benefits?

You probably know that life insurance has a death benefit. The death benefit is the amount of money your beneficiary will receive income tax-free upon your death.

Pretty easy to understand, right?

Well, you may not know that the life insurance business, especially the term life insurance market, is very competitive. In some ways, term life insurance is simply a commodity. Hence, if you have no health complications, good weight and height (BMI), non-tobacco user, etc, you can probably apply for life insurance on your own without speaking to an agent, with no issue, and get the cheapest policy possible.

However, because of the “commoditization”, carriers have been trying to position themselves in niches.

For example, one carrier might position itself as the “go-to” insurance carrier for type 2 diabetics. Another one might position itself with a simple, quick, and easy underwriting process.

Finally, many carriers have offered “living” benefits instead of the aforementioned plain, boring death benefits-only on their policies.

Nowadays, however, many life insurance carriers offer living benefits on their plans or as a rider. It’s important to understand “what’s under the hood” with these living benefits compared to other alternatives.

Before we get into all of that, let’s discuss what living benefits really are.

What Are Living Benefits?

Life is full of disruptions, unplanned, and unfortunate situations. Living benefits can help with some of these disruptions.

Life is full of disruptions, unplanned, and unfortunate situations. Living benefits can help with some of these disruptions.

The term “living benefits” simply means to utilize the death benefit before death. That is, you use it while you are alive. There are three common areas where the life insurance carrier allows you to use the death benefit before death:

(1) chronic care situations (i.e. similar to nursing home care)

(2) critical illnesses such as cancer and heart attacks

(3) terminal illness

The third area, terminal illness, has been available for some time through many carriers.

The other two areas are relatively new to consumers, although many carriers now include these options on their policies, either automatically or through a rider.

If you were diagnosed with cancer, wouldn’t you like to receive money to help you through your treatment? Of course, you would. That’s what living benefits do. You can use this money for whatever you want: your medical bills, pay the mortgage, child care, etc.

Are you wondering where the money comes from?

If you said, the death benefit, you are right. The advancement reduces your life insurance death benefit.

The life insurance industry commonly calls this advancement “accelerated” benefits.

Every carrier analyzes your situation a bit differently. They will analyze the severity of your condition and make you an offer, in concert with the terms and provisions of your policy. The advancement is income tax-free as you are advancing the death benefit early.

However, you don’t have to take the carrier’s offer. You can decline the offer and let your life insurance benefit remain intact.

We routinely describe a life insurance policy with living benefits as a “swiss army knife”.

Description Of The Common Living Benefits

Here is a description of the common living benefits:

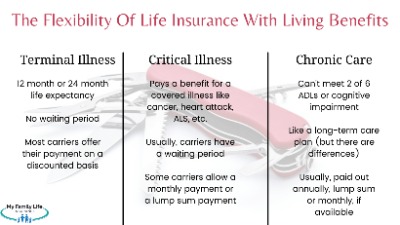

(1) chronic care – you can receive money to take care of your chronic care or custodial care needs. Usually, this means if you can’t meet 2 of 6 activities of daily living or have a cognitive impairment. If this sounds like the definition of eligibility for long-term care, you are right. However, I must stress that the chronic care option is NOT long-term care insurance. This living benefit simply pays a lump sum benefit if you can’t meet 2 of 6 ADLs or if you are cognitively impaired. Most carriers require the permanence of your condition or illness as well.

custodial care needs. Usually, this means if you can’t meet 2 of 6 activities of daily living or have a cognitive impairment. If this sounds like the definition of eligibility for long-term care, you are right. However, I must stress that the chronic care option is NOT long-term care insurance. This living benefit simply pays a lump sum benefit if you can’t meet 2 of 6 ADLs or if you are cognitively impaired. Most carriers require the permanence of your condition or illness as well.

(2) critical illness – will pay a benefit if you are diagnosed with a covered illness such as cancer, heart attack, stroke, ALS, etc. You can then use this money for your insurance bills, doctor and hospital care, etc.

(3) terminal illness – if a doctor says you have fewer than 12 to 24 months to live, generally speaking, you can receive money for your use. You can use this money for your care, to take a vacation with your loved ones, or use it for anything you want.

Let’s talk about how the living benefits work next.

How Does Advancement Of The Death Benefit Work?

Every carrier approaches the advancement differently.

First, most carriers require a doctor to certify the critical illness, terminal illness, or chronic need.

Assuming that happens, you’ll need to pay a nominal administration fee like $250.

Here is one example of how carriers accelerate the death benefit for your needs. Keep in mind, carriers always require some amount of death benefit remaining as life insurance.

Critical illness: maximum acceleration allowed is 25% of the death benefit or $50,000, whichever is less.

Chronic care: minimum acceleration is 5% of the death benefit (annual election) or $50,000, whichever is less.

Terminal illness: minimum 10% of the death benefit or $100,000, whichever is less.

The carrier bases your advancement on your situation, the prognosis for recovery, and the remaining life expectancy among other variables.

Then, the carrier subtracts the amount from your death benefit.

Every carrier is different, and we are happy to go over the different options.

Why Life Insurance With Living Benefits Is Worth It

Here’s why life insurance with living benefits is worth it.

Here’s why life insurance with living benefits is worth it.

- First, the additional cost isn’t that much more, and

- These unfortunate scenarios happen more often than you think

Let’s discuss the last comment first.

A cancer diagnosis, terminal illness, and/or skilled nursing or nursing home care happens way more often than you think.

Here are some real statistics.

One-third of deaths in the US are caused by heart disease, stroke, or cardiovascular disease.

As of this writing, more than 6 million US citizens have Alzheimer’s.

Cancer happens anytime. 1 in 2 men and 1 in 3 women will develop cancer at some point in their lifetime.

While 1 in 2 people age 65 and over will need some type of long-term care insurance in the rest of their lifetime, 37% of long-term insurance claims are made by those age 64 and younger.

Medical costs are the #1 reason why people go bankrupt. You didn’t know that? Unfortunately, your health insurance won’t cover everything.

Wouldn’t it be great to have coverage for these unfortunate, common incidents?

With life insurance with living benefits, the answer is: yes. You can advance part of the death benefit early for your needs and care.

This is why life insurance with living benefits is worth the money. It gives you and your family financial flexibility when your family needs the money the most.

But, how much more are we talking about? Let’s discuss the cost next.

Cost Of Life Insurance With Living Benefits. Here Is Why It Is Worth The Cost

Many years ago, I wrote an article about how life insurance with living benefits was a waste of money. The reason was the cost difference between a traditional term policy and that with living benefits was quite large. You could add stand-alone plans which cost much less, have great coverage, and still save money.

However, the life insurance market has changed significantly since then.

Now, the cost differential between traditional life insurance and those that offer living benefits is very small.

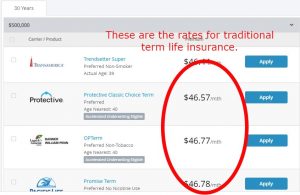

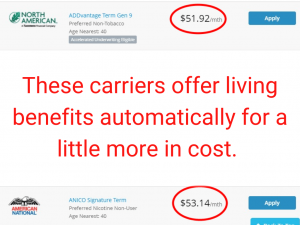

Check this out. Here is an example. Let’s say a female age 40 wants $500,000 of life insurance. She is a preferred health class. Here is a snapshot of available carriers and rates.

But scroll a little more, and you can see the cost of term life insurance offering living benefits is only a little more per month.

The additional cost is usually immaterial, yet the benefits are huge. This is why we suggest that life insurance with living benefits is worth the extra cost.

usually immaterial, yet the benefits are huge. This is why we suggest that life insurance with living benefits is worth the extra cost.

You can see that the difference in cost is only $5 to $10 more per month, maybe more, maybe less.

Do you think this incremental cost is worth the extra money? Yes! For $10 more per month (give or take), you can receive the death benefit sooner for a:

- terminal illness,

- critical illness like cancer or heart disease (which happens way more than you think), or

- chronic care like nursing home care or skilled nursing care

To reiterate, the increased incidence of a critical illness, terminal illness, or chronic-care need, coupled with the smaller, incremental cost makes life insurance with living benefits worth the money.

Types Of Life Insurance That Offers Living Benefits

Not all carriers offer living benefits on their life insurance. Generally speaking, living benefits are available on the following types of life insurance:

Index universal life

Whole life

We discuss in more detail in our article guide about life insurance with living benefits.

Now You Know Life Insurance With Living Benefits Is Worth The Money

We believe life insurance with living benefits is worth the extra money. See our comparison above. The living benefits add another $5 or $10 per month. In the grand scheme of things, $10 per month isn’t a big deal. What’s $10? It’s another $0.33 per day. Certainly, the living benefits add value for 33 cents more per month, give or take.

Do you have any questions? Feel free to contact us or use the form below.

We at My Family Life Insurance pride ourselves on serving our clients with their best interests first. Many agents say this, but their actions don’t match their words. Chat with us; there is no risk in doing so. If we can’t help you, we will point you in the right direction as best we can. We’ll part as friends, and you can reach back out to us anytime. How can we say this? It is the only way we know how.

If you want to learn more about life insurance with living benefits, know your other options, or work with an agency that values you and your family, contact us. Or, use the form below.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".

4 thoughts on “Here Is Why Life Insurance With Living Benefits Is Worth The Money | This Type Of Life Insurance Provides More Flexibility”

Comments are closed.

I do not agree with you at all and here is why.

if i have Million dollar policy with living benefits and get diagnosed with Cancer i will get 90% of face value Tax free Money .

now i can focus on my treatment and have a peace of mind that my family will not loose their savings or house , plus Majority of my bills will be paid from my health insurance.

so i do not have to die to use my policy and i rather be alive and stay with my family than wait to die so my family can have money .

so its win win situation for me and my family ,they have me as a father or Husband and we also have money.

the company i work for life insurance policy come with Living Benefits with no extra charge and its cheapest in the Market.

IUL policy with living benefits provide 3 things every one needed , INVESTMENT,RETIREMENT and PROTECTION .I can beat 401k or any other Retirement plan easily and its all tax free.

so i thing your approach is totally different for IUL living Benefits.

Thanks

Mohammed khan

Hi Mohammed,

Thanks for your comment. As we said in the article, permanent insurance (that includes IULs) with living benefits can make a lot of sense. If someone chooses living benefits on term life insurance, he or she should consider increasing the death benefit to compensate for any potential distribution.

John

what if you have a disability but it is not life threatening and doesn’t affect your independence or ability to function but I was a physical therapist and with a shoulder injury that causes my shoulder to keep coming out of joint I could not lift patients or adequately perform my duties required for that type of job. I WAS GIVEN disability as result because no body would hire me anymore as a physical therapist and because many jobs with my degree experience require heavy lifting so I went back to school for holistic health Practitioner and will soon be starting the ticket to work again program with social security. I would like to know do I qualify for any type of life insurance policy with living benefits for later in life if needed and death benefits. I am healthy never had heart problems or cancer no diabetes good blood pressure no chronic illnesses do not take medications except I do use tramadol when needed for my shoulder when it goes out of socket which only occurs if I lift heavy things which I avoid. I exercise regular never smoked do not use alcohol and am 59 year old female. Can I get life insurance with living benefits in my situation? I know the living benefit may not cover anything preexisting such as the shoulder injury but that isnt what a living benefit is for anyways and would be more like what your article discussed if later in life had medical problems that were life threatening which I hope never happens but its a good thing to have such insurance if it did. My biggest desire and concern is to have benefits available for my living family I should ever pass on and also benefits for things like burial arrangements and take care of different bills so my family would not be burdened. The main person I would be concerned for is my mom who lives with me and is 82 years old. Of course I hope to live longer as since she is much older but she is also very healthy her mom my grand mother lived to be 100 and my grand father to 98 and my uncle is still alive at 90 so you never know and both sides of moms family have been healthy and lived long lives. I want to be sure of anything ever happened to me she is taken care of without concern of her losing my home which I still have 22 years of mortgage left and owe $60 k on still and I would want to be sure she wasn’t burdened with having to come up with funds for funeral and burial arrangements if anything happened to me as I know from my friend passing 3 years ago who had no life insurance how expensive funerals have become and her family did not have the funds to cover it and it was so hard on them. thankfully everyone chipping in from friends to other family managed to scape enough for a nice funeral and burial as her desire like mine is burial not cremation but it is costly like almost 8000 for my friends funeral and burial and that was a basic one it can be much more .i saw a tv add on living life insurance and decided to look it up and found your article and though after reading maybe I do have options for my situation and decided to email you to see what is available for me.

Hi Kathy,

Thanks for reaching out to us. Yes, you probably can obtain life insurance with living benefits. Feel free to call our office, and we would be happy to help and discuss more specifics.

John